WASHINGTON, April 10 (Reuters): U.S. consumer prices increased more than expected in March as Americans paid more for gasoline and rental housing, leading financial markets to anticipate that the Federal Reserve would delay cutting interest rates until September.

The third straight month of strong consumer price readings reported by the Labor Department on Wednesday followed on the heels of news last week that job growth accelerated in March, with the unemployment rate slipping to 3.8% from 3.9% in February. Fed Chair Jerome Powell has repeatedly said the U.S. central bank is in no rush to start lowering borrowing costs.

The stubbornly higher cost of living looms large over the Nov. 5 U.S. presidential election.

“The data does not completely remove the possibility of Fed action this year, but it certainly lessens the chances the Fed is cutting the overnight rate in the next couple months,” said Phillip Neuhart, director of market and economic research at First Citizens.

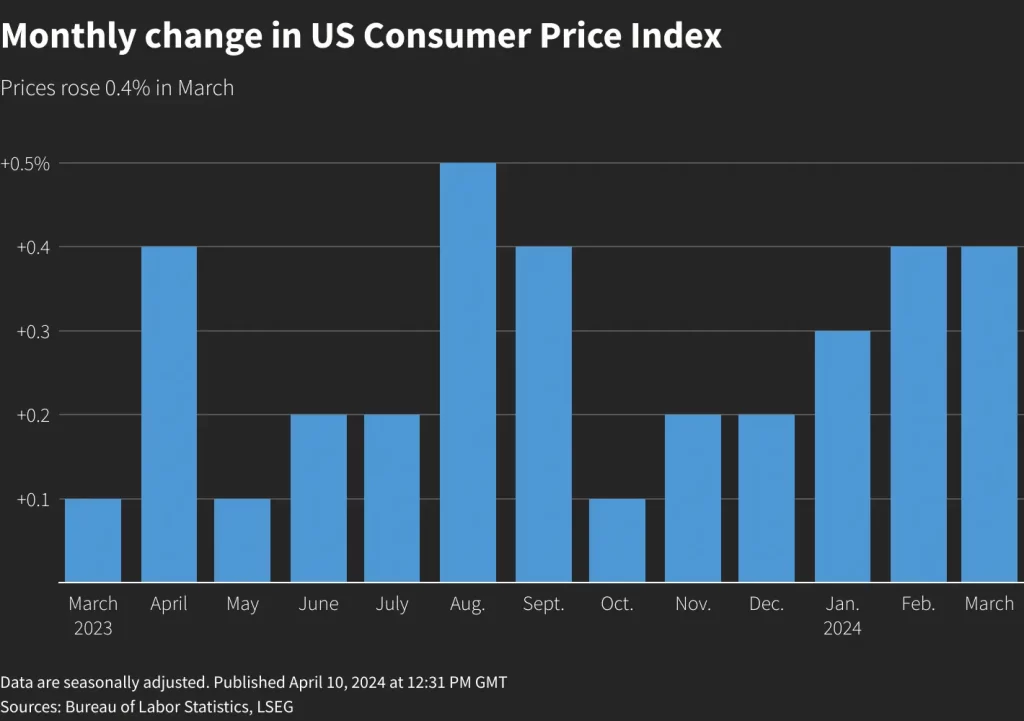

The consumer price index rose 0.4% last month after advancing by the same margin in February, the Labor Department’s Bureau of Labor Statistics said. Gasoline prices rose 1.7% after increasing 3.8% in February. Shelter costs, which include rents, rose 0.4%, matching February’s gain.

Gasoline and shelter accounted for more than half of the increase in the CPI. Food prices rose 0.1%, though grocery food inflation was unchanged amid declines in the costs of butter and cereals and bakery products, which recorded their largest monthly decrease since 1989.

But prices for meats and eggs rose. There was a modest increase in the prices of fruits and vegetables.

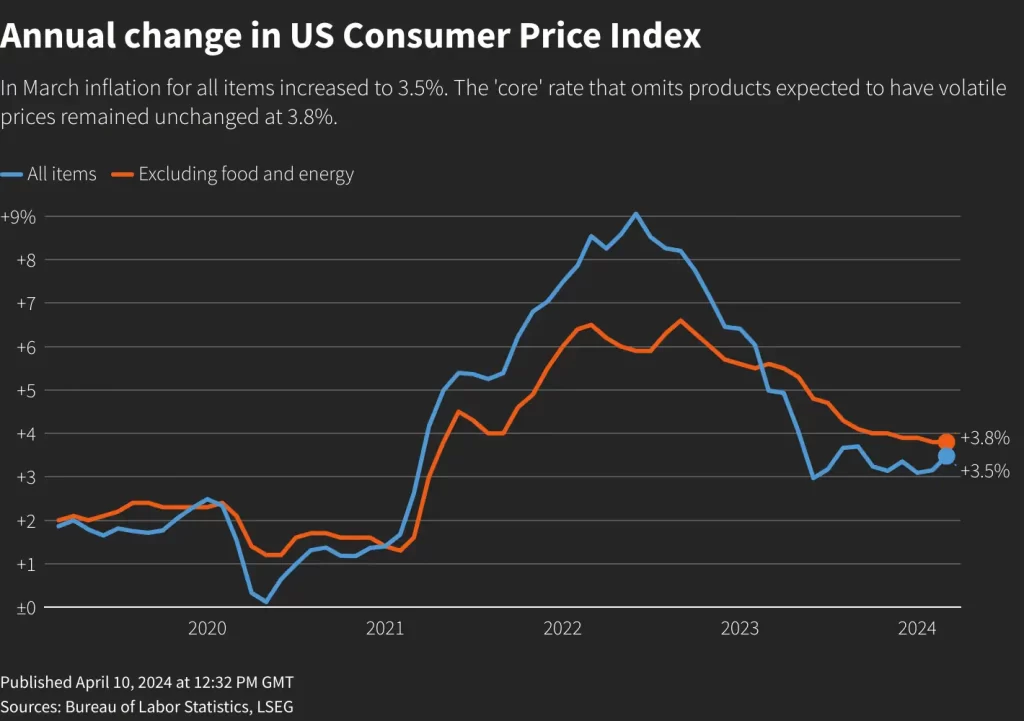

In the 12 months through March, the CPI increased 3.5%, the most since September, also as last year’s low reading dropped out of the calculation. That followed a 3.2% rise in February. The Fed has a 2% inflation target. The measures it tracks for monetary policy are running considerably below the CPI rate.

Economists polled by Reuters had forecast the CPI gaining 0.3% on the month and advancing 3.4% on a year-on-year basis.

STALLING DISINFLATION

Though the annual increase in consumer prices has declined from a peak of 9.1% in June 2022, the disinflationary trend has virtually stalled in recent months.

Shortly after the data, financial markets pushed back their expectations for the first rate cut to September from June, according to CME’s FedWatch Tool. They now expect only two rate cuts instead of the three envisaged by Fed officials last month. A minority of economists see the window for rate cuts closing.

The central bank has kept its policy rate in the 5.25%-5.50% range since July. It has raised the benchmark overnight interest rate by 525 basis points since March 2022.

U.S. stocks opened lower. The dollar rallied against a basket of currencies. U.S. Treasury prices fell.

Excluding the volatile food and energy components, the CPI gained 0.4% last month after a similar rise in February and January. The so-called core CPI was boosted by a 0.5% increase in rents after rising 0.4% in February.

Owners’ equivalent rent (OER), a measure of the amount homeowners would pay to rent or would earn from renting their property climbed 0.4% after a similar rise in February.

There were also increases in the costs of motor vehicle insurance, healthcare, apparel and personal care. But prices for used cars and trucks, recreation and new vehicles fell. Core goods prices fell 0.2% after edging up 0.1% in February.

Services excluding energy rose a solid 0.5% after increasing by the same margin in February. In the 12 months through March, the core CPI rose 3.8%, matching February’s increase.

FAQs on US consumer prices and economic trends

What was the main reason behind the impressive March inflation in the U.S. consumer prices?

Consumer Prices in March, went up driven by the rising prices of gasoline and rental housing.

Perhaps the most important thing is the consumer price index (CPI) in March – how does it compare to previous months?

March saw consumer price index regret 0.4% which was same as in the month of February stating the persistence of month-on-month escalating prices.

How did these variables, such as gasoline and accommodation charges, influence the inflation rate as measured by the CPI?

Gasoline and housing costs made up virtually more half of gasoline and shelter talented the rise so much.

Inflation 12 months-long rate up till March was, what rate?

The rise of the all-round index, that is, the consumer price index, was 3.5% in the past 12 months, has not been since September in 1962, but still below the Federal Reserve’s price stability target rate.

Did the financial markets organize their stance accordingly to the CPI data release?

The financial markets have postponed their expectations of the first-quarter rate cut until September, as against the earlier prediction of a cut in June. Moreover, they are now penciling in a maximum of two quarter-point rate cuts instead of the previous three cuts recorded in the last meeting.

Except FAQs. This report is given by Reuters. The Sen Times holds no responsibility for its content.