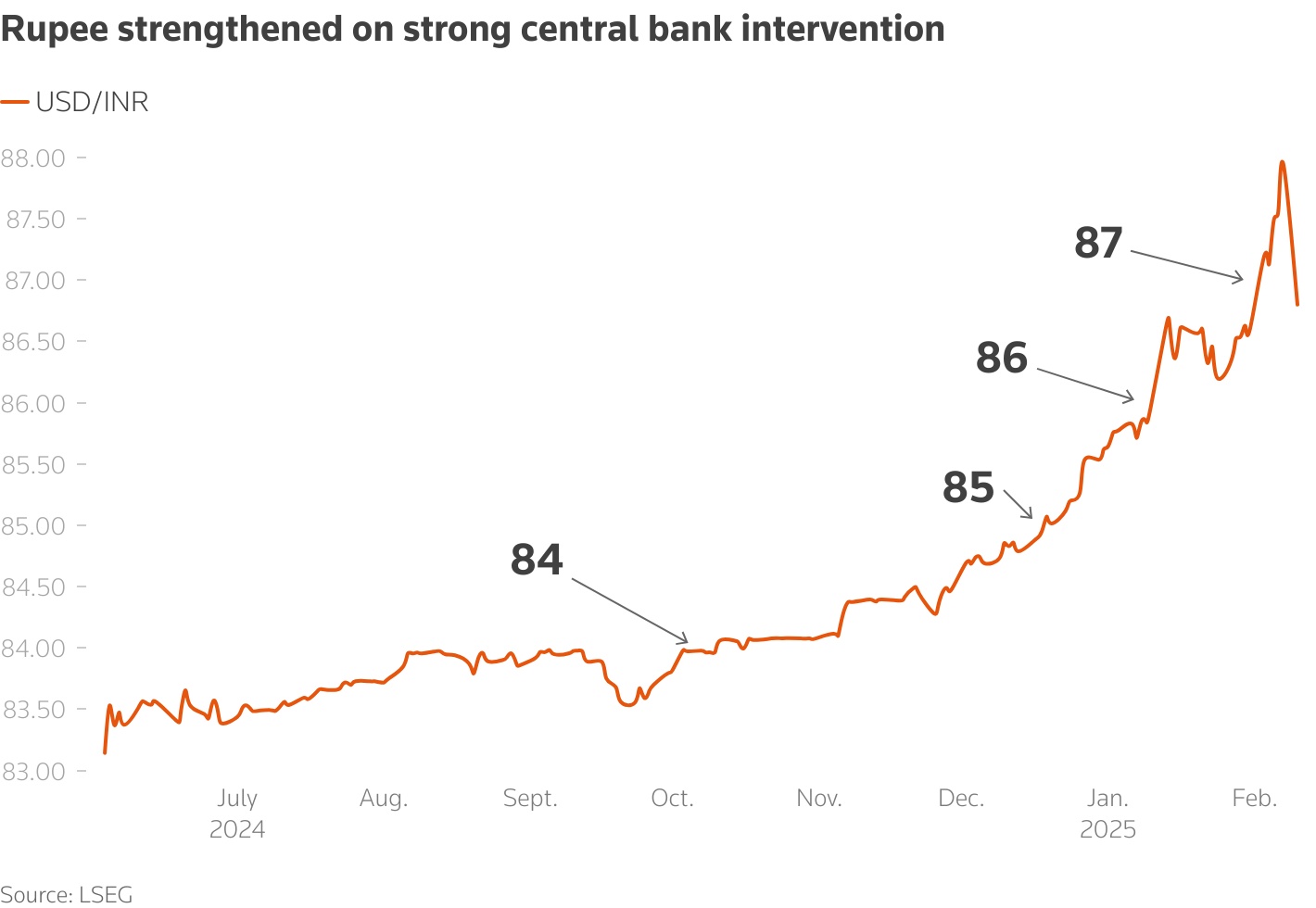

MUMBAI, Feb 11 (Reuters) – The Indian rupee rallied on Tuesday on the back of strong intervention by the RBI (Reserve Bank of India), which traders said could deter heavy speculative positioning against the currency in the near term.

The rupee closed 0.7% higher at 86.8275 against the U.S. dollar, logging its biggest one-day gain since March 2023.

The RBI likely sold between $4 billion and $7 billion to shore up the currency on Monday to help it hold above the 88 handle and the intervention continued on Tuesday, traders said. The currency hit its all-time low of 87.95 in the previous session.

The intervention “overpowered the market and led to cutting of long positions (on USD/INR),” a trader at a mid-sized foreign bank said, noting that trading volumes on the day were “quite huge.”

Concerns about a potential trade war, persistent foreign selling from domestic stocks and policy easing by the RBI have weighed on the rupee this year and prompted speculators to wager against the currency.

Foreign investors have net sold nearly $10 billion of local stocks so far this year, while the RBI cut policy rates last week for the first time in nearly five years to shore up growth in a sluggish economy.

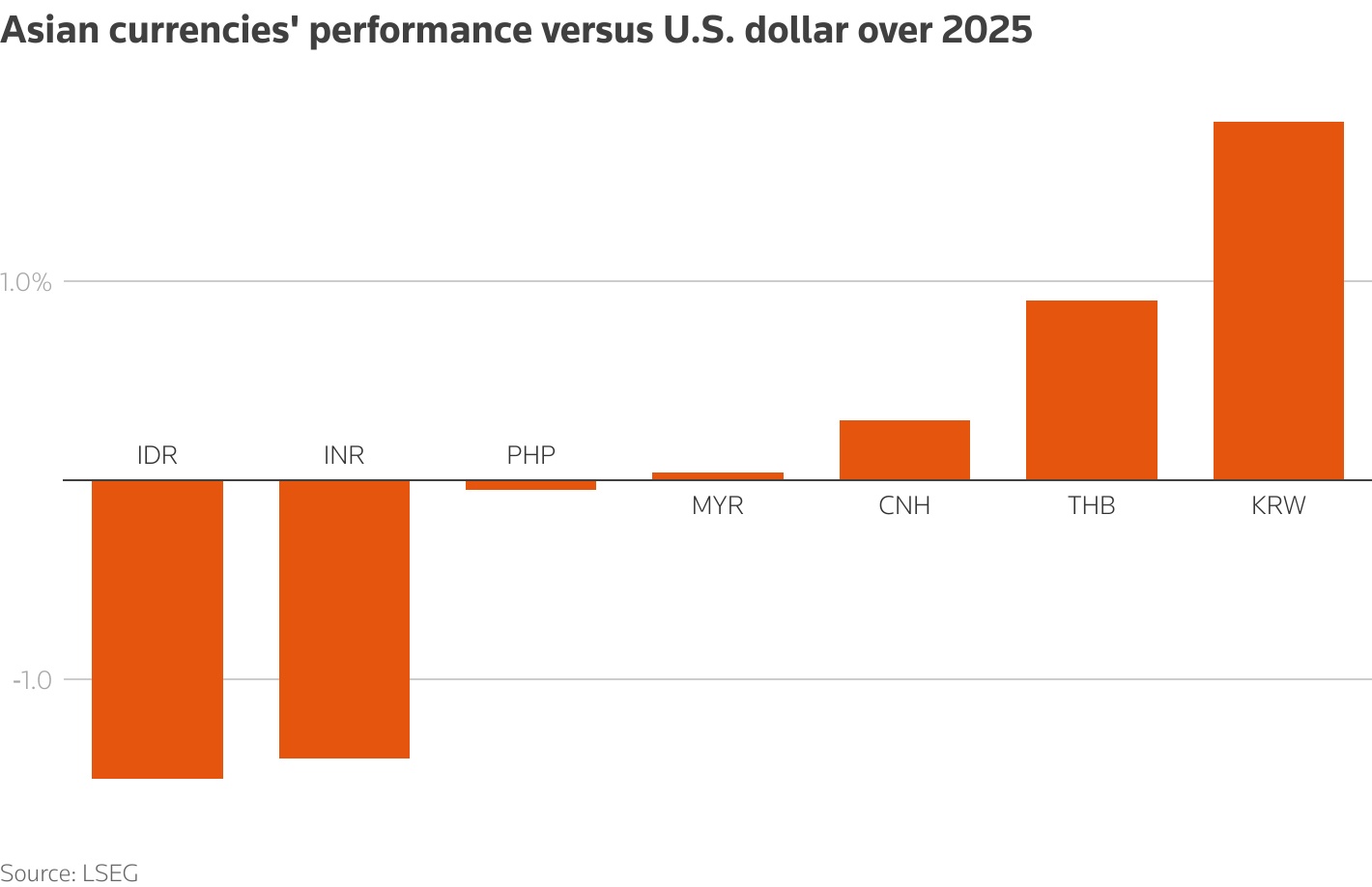

While the RBI’s intervention helped the rupee on Tuesday, it has declined over 1% in 2025 so far and is among Asia’s worst-performing currencies.

The way the RBI interventions have panned out over the last two days, it would be better to “go with the flow” on the rupee, said Dilip Parmar, a foreign exchange research analyst at HDFC Securities.

On a technical basis though, Parmar expects the rupee to find resistance near 86.30 and pegged support for the currency at 87.40.

Meanwhile, the dollar index dipped to 108.2 as focus turned to remarks from U.S. Federal Reserve Chair Jerome Powell later in the day.