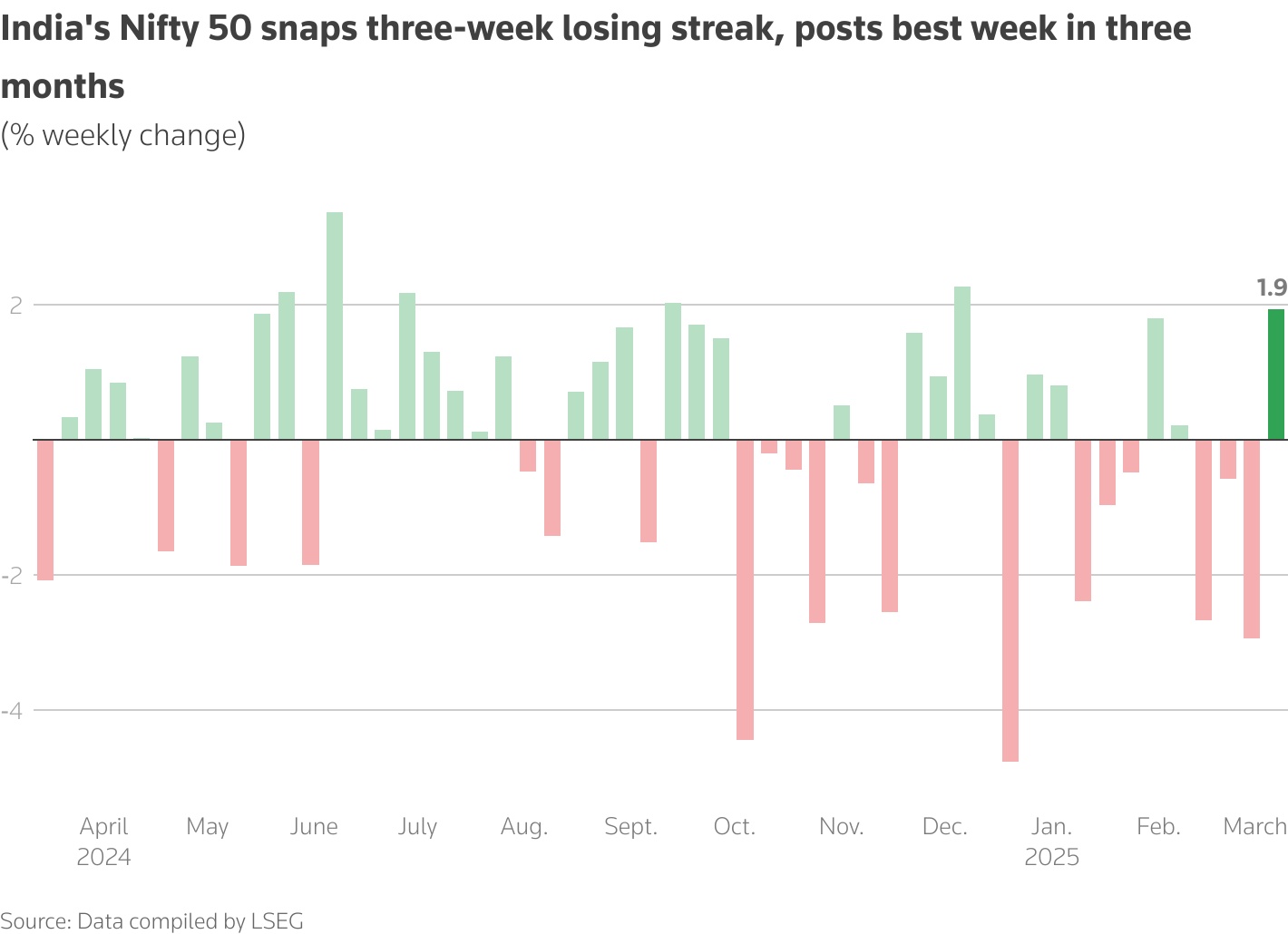

March 7 (Reuters) – India’s benchmark index Nifty 50 logged its best week in three months, led by heavyweight Reliance Industries and metal stocks, as losses in the past three weeks triggered bargain buying.

On the day, the Nifty 50 rose 0.03% to 22,622.5, while the BSE Sensex ended 0.01% lower at 74,332.58.

The Nifty rose about 1.9% this week, its best in three months, while the Sensex gained 1.6% and logged its highest weekly gains since January-end.

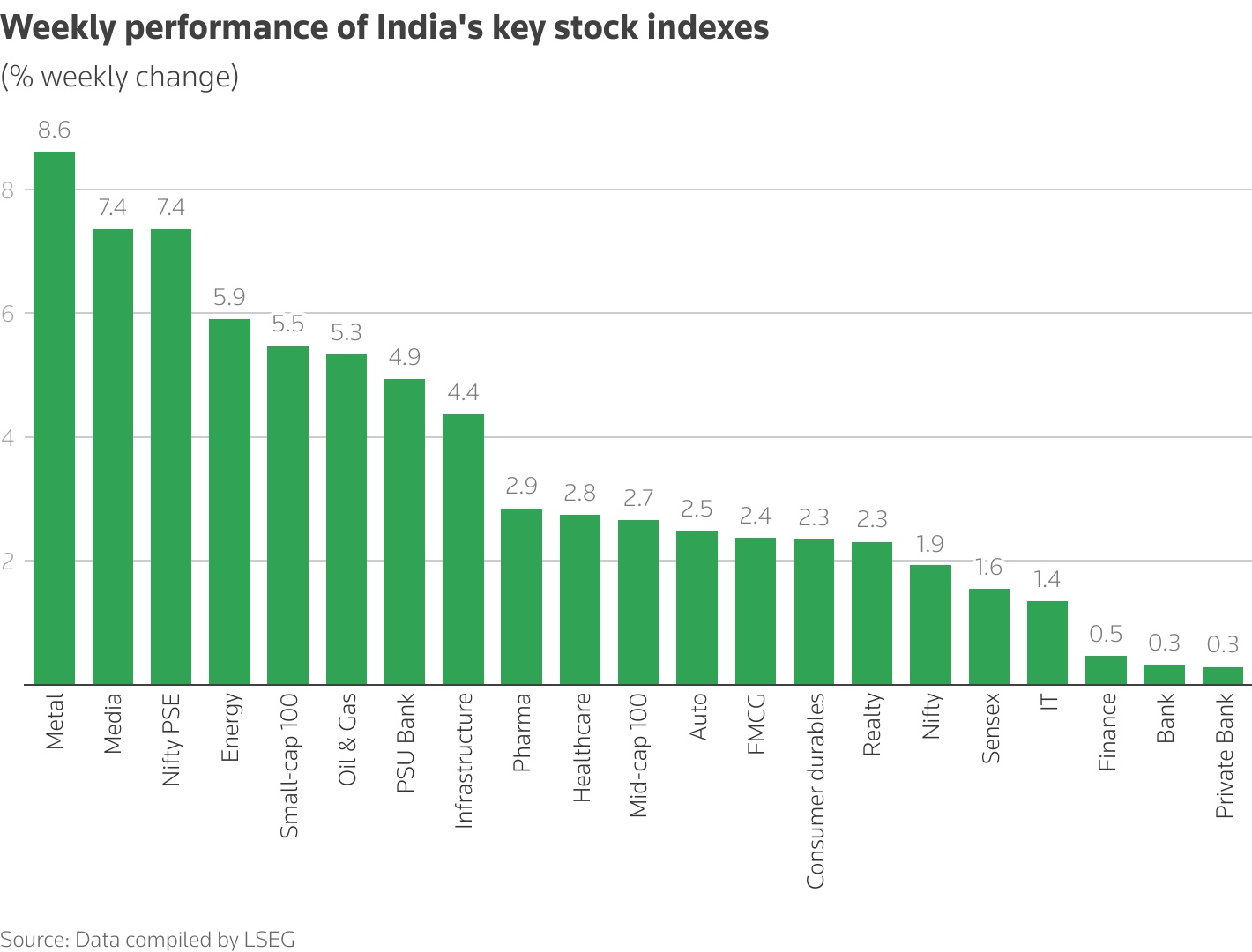

All 13 major sectors ended the week higher, with mid-cap and small-cap stocks up 2.66% and 5.5%, respectively.

Sentiments across Asian equities improved this week as Trump temporarily suspended the 25% tariffs on most goods from Mexico and Canada, which could “set the stage for a potential market recovery, if sustained,” said Subho Moulik, founder and chief executive of global investing platform Appreciate.

Reliance, the heaviest-weighted stock on the Nifty 50, climbed 3.3% on the day.

The stock, which fell to a 15-month low on Monday, bounced back to end the week 4.1% higher, after a couple of global brokerage firms upgraded it citing attractive valuations.

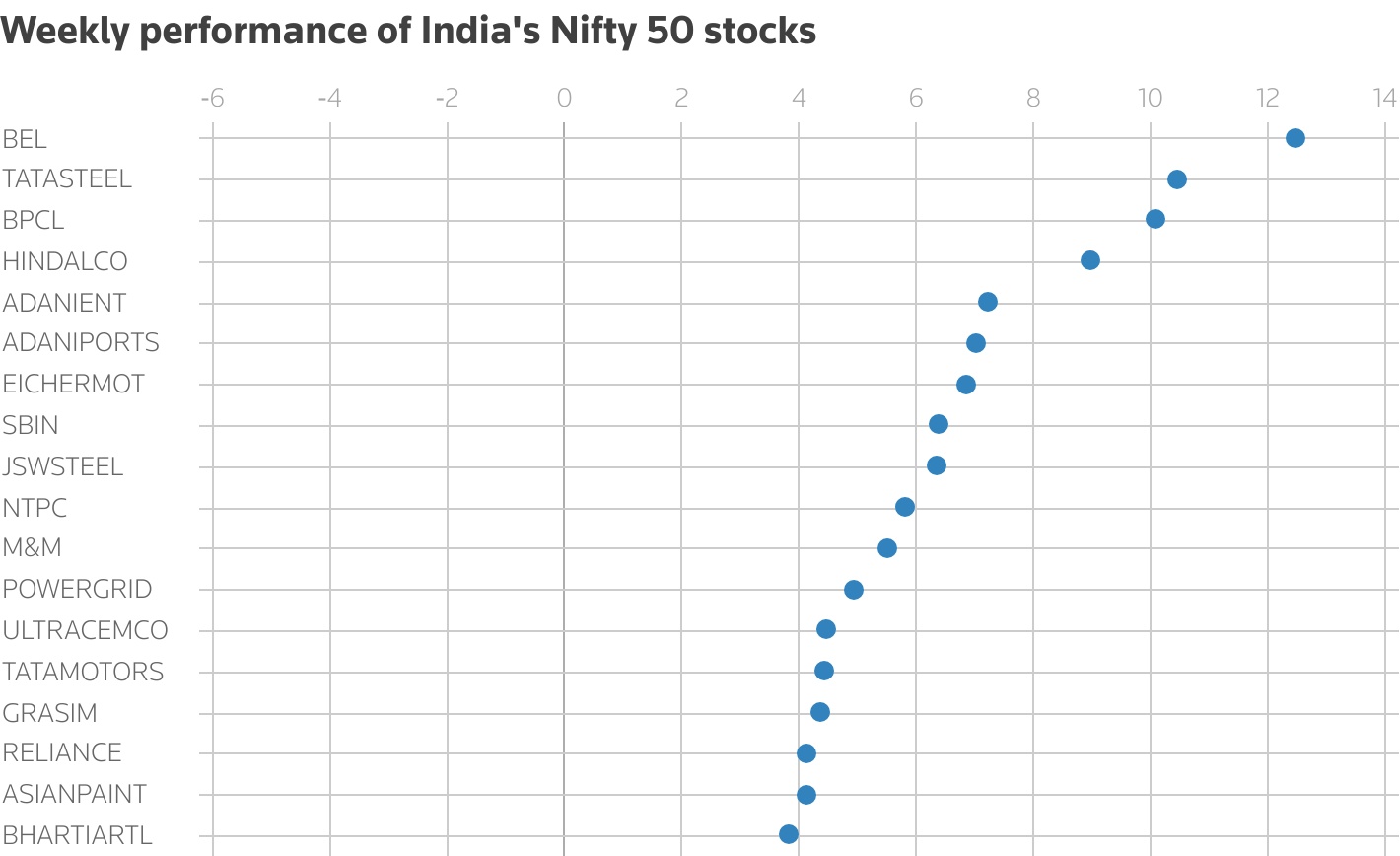

Metals rose 8.6% to register their best week in nearly four years on hopes of more stimulus measures from China and its plans to cut steel output.

Mahindra & Mahindra , expected to be the worst hit from a potential removal of import duty on U.S. cars, rose 5.5% this week after multiple brokerages said the move would have minimal impact on India’s auto makers.

Despite the weekly gains, the benchmarks are still down about 14% from the record high levels hit in September, hurt by slowing earnings, foreign outflows worth $27.5 billion and trade worries.

While the recent correction could aid bargain buying in large-caps where valuations have turned attractive, uncertainty will prevail in the market until clarity emerges on reciprocal tariffs, three analysts said.