MUMBAI, Oct 25 (Reuters) – RBI is keen that banks pass on the benefits of higher interest rates to account holders by raising the rates they offer on savings’ deposits, but lenders are pushing back in a bid to bolster margins, several banking sources said.

Savings accounts are low interest rate-bearing deposits offered by Indian banks, forming a third of their total deposits.

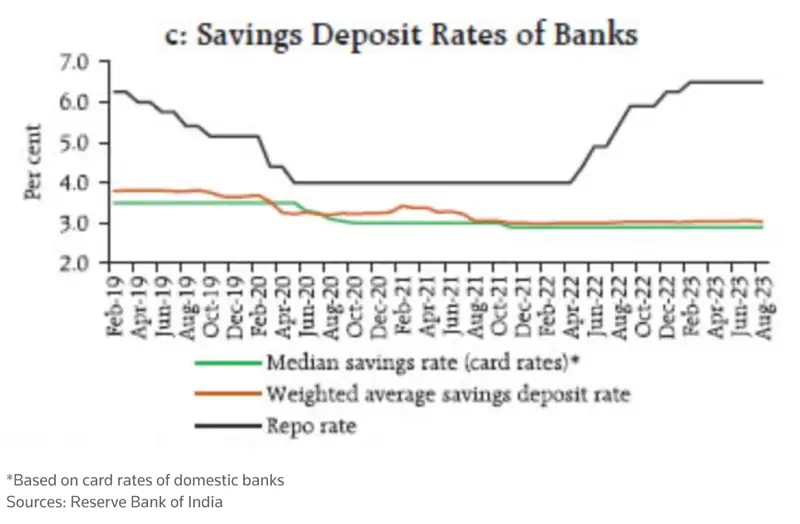

The Reserve Bank of India (RBI), which has increased the policy repo rate by 250 basis points to 6.50% in the last fiscal year, wants to ensure a more complete transmission of monetary policy, a source familiar with the central bank’s thinking said.

“A majority of interest rate transmission has transpired because of the external benchmark lending rate, but a small portion remains, as savings deposit rates are still low,” he said requesting anonymity, as he is not authorised to speak to the media.

Public sector banks offer interest rates between 2.70% to 4% on savings deposits, while large private banks offer rates between 3% to 4.50%.

Savings deposits rate of banks vs RBI’s repo rate

The RBI has been nudging banks at meetings to raise savings deposit rates and may need to push them again if required, the same source said.

The RBI did not immediately respond to a Reuters’ email seeking comment.

“The operational cost and technological cost of maintaining a savings account is quite high. Even a 20 bps-25 bps increase would impact the entire book of lenders,” said a top official at a private sector bank, who also declined to be named because he was not authorised to speak to media.

“This could prove to be margin dilutive at this point,” he added.

The RBI said in its monetary policy report that while the increase in term deposit rates in the current tightening cycle has exceeded that in lending rates, savings deposit rates have remained almost unchanged.

“This has moderated the increase in the banks’ overall cost of funds and is mirrored in higher net interest margins,” it added.

Yes Bank, Kotak Mahindra Bank and IndusInd Bank are among lenders that have recently said they have no plans to raise savings deposit rates.