MUMBAI, Feb 8 (Reuters) – India’s key rate was left unchanged for a sixth straight meeting on Thursday, in line with expectations, as inflation remained above the RBI (Reserve Bank of India) 4% medium-term target while economic growth continued to be resilient.

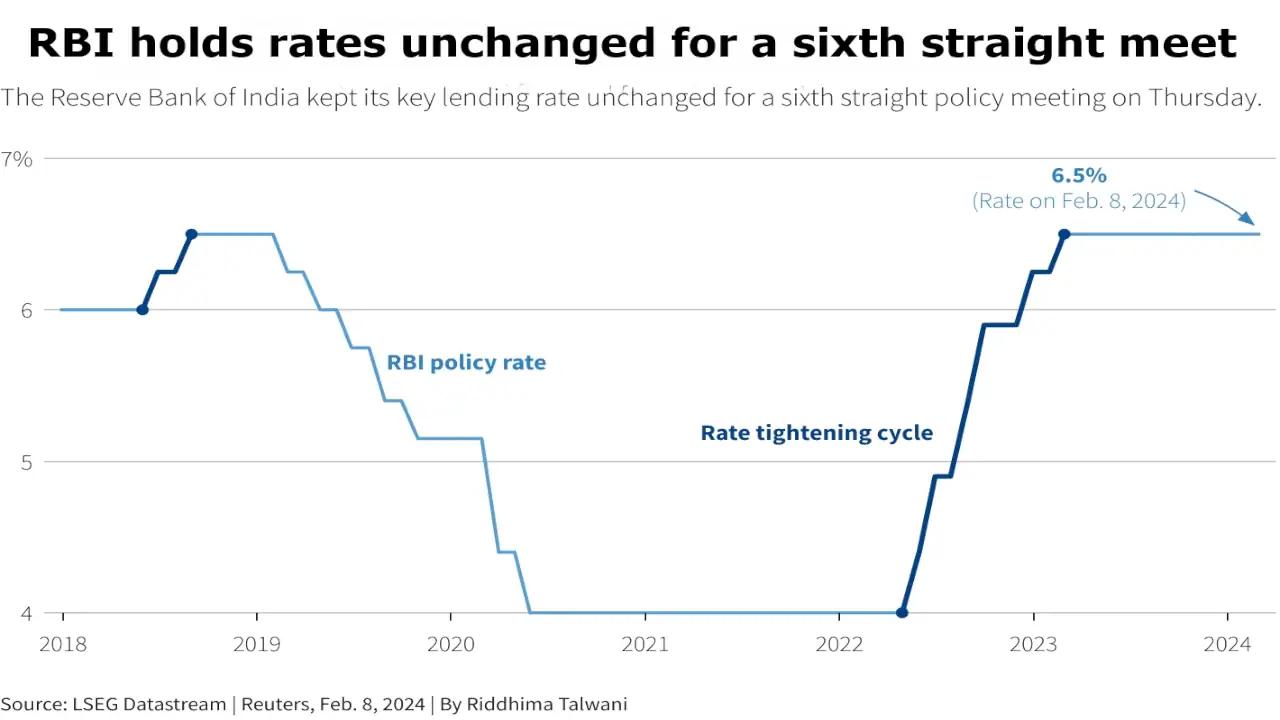

The six-member monetary policy committee, consisting of three RBI and three external members, left the key repo rate, opens new tab unchanged at 6.50% after having raised it by 250 basis points between May 2022 and February 2023.

The committee said it would remain focused on ‘withdrawal of accommodation’, suggesting the central bank intends to keep monetary policy restrictive.

Monetary policy must continue to be actively disinflationary, RBI Governor Shaktikanta Das said in his statement.

Five out of six members voted in favour of the rate decision and the monetary policy stance of ‘withdrawal of accommodation’.

The Indian benchmark bond yield rose after the decision while equity markets, opens new tab, opens new tab dipped and the rupee was largely unchanged, trading at 82.92 per dollar.

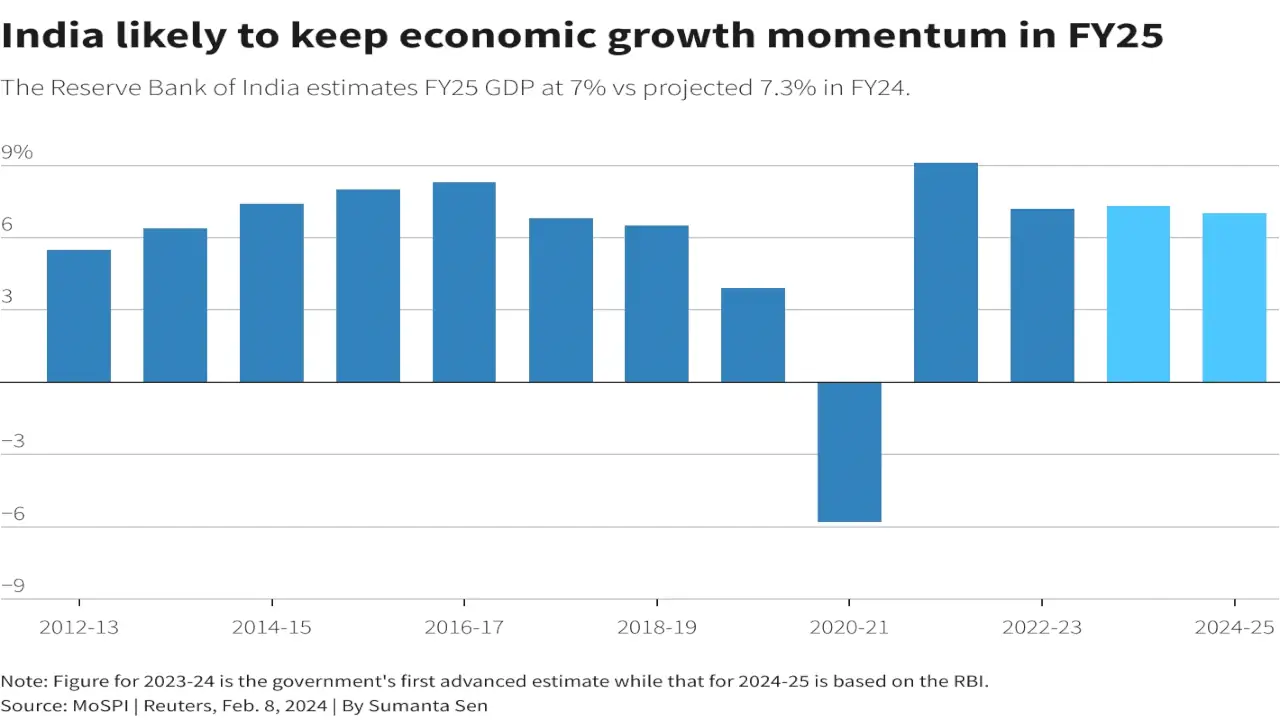

The Indian economy is expected to expand 7.3% in the year ending March 31, 2024 and the central bank projected growth of 7% in 2024-25, in line with the federal government’s forecast.

Against an uncertain global environment, the Indian economy has performed “remarkably well” in recent years, Das said. Growth is outpacing most forecasts while inflation is on a downward trajectory, he said.

The RBI estimates retail inflation to come in at 5.4% in 2023-24, unchanged from its previous projection. For next year, assuming normal rains, retail inflation is expected at 4.5%, Das said.

Annual retail inflation picked up to 5.69% in December from November’s 5.55%, well above the RBI’s 4% target. However, a sustained slowdown in core inflation and a fiscally prudent budget have raised expectations for an easing in inflation.