MUMBAI, Dec 6 (Reuters) – The RBI (Reserve Bank of India) kept its key interest rate unchanged on Friday but cut the cash reserve ratio (CRR) that banks are required to hold, effectively easing monetary conditions as economic growth slows.

The country’s GDP growth rate fell to 5.4% in the July-September quarter, its slowest pace in seven quarters, while inflationary pressures are on the rise again and the rupee is under pressure, limiting the RBI’s room to manoeuvre.

The CRR was cut by 50 basis points to 4%, effective in two tranches on Dec.14 and Dec. 28.

The cut will infuse 1.16 trillion rupees ($13.72 billion) into the banking system and bring down market interest rates.

The Monetary Policy Committee (MPC), which consists of three RBI and three external members, kept the repo rate unchanged at 6.50% for an eleventh straight policy meeting.

Four of six members of the rate panel voted for a status quo in rates.

The committee also retained its policy stance at “neutral”.

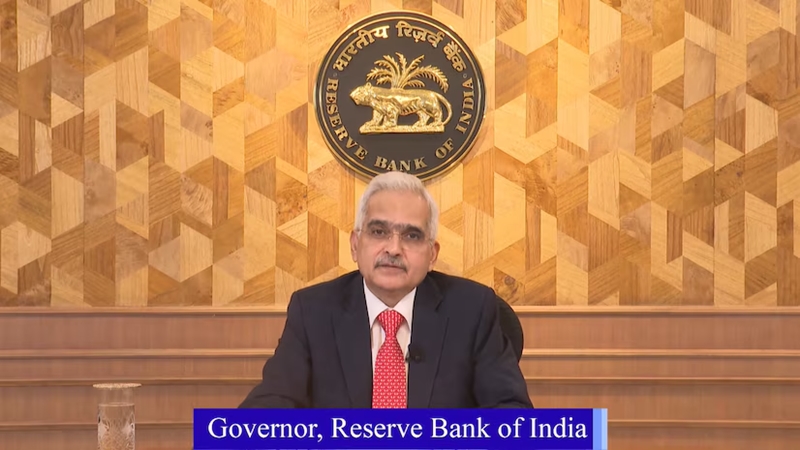

Price stability is important to people because it impacts their purchasing power, said RBI Governor Shaktikanta Das, adding that ensuring “durable” price stability is critical to ensuring high growth in the economy.

Policy support may be needed if the growth slowdown “lingers”, Das said.

For now, the RBI sees economic growth as resilient, Das said. Not withstanding the recent aberrations in growth and inflation, domestic conditions are on a balanced path, he said.

India’s benchmark 10-year bond yield was up 4 basis points to 6.7207% after the announcement of the CRR cut, while the rupee declined marginally to 84.6725 per U.S. dollar from 84.6600. Benchmark equity indexes pared their losses after earlier declining on the decision to keep interest rates steady.

India’s annual retail inflation rose to 6.21% in October, breaching the central bank’s tolerance band for the first time in more than a year.

The central bank raised its inflation forecast for the current financial year to 4.8% from 4.5% previously.

The GDP slowdown bottomed out in the July-September quarter and has seen a pick-up in subsequent months led by festival spending and strong agricultural output following a good monsoon, Das said.

The central bank lowered its growth forecast for the year ending March 2025 to 6.6%, from its earlier forecast of 7.2%.

($1 = 84.5500 Indian rupees)

(Only the headline and the picture of this report may have been reworked by The Sen Times staff.)