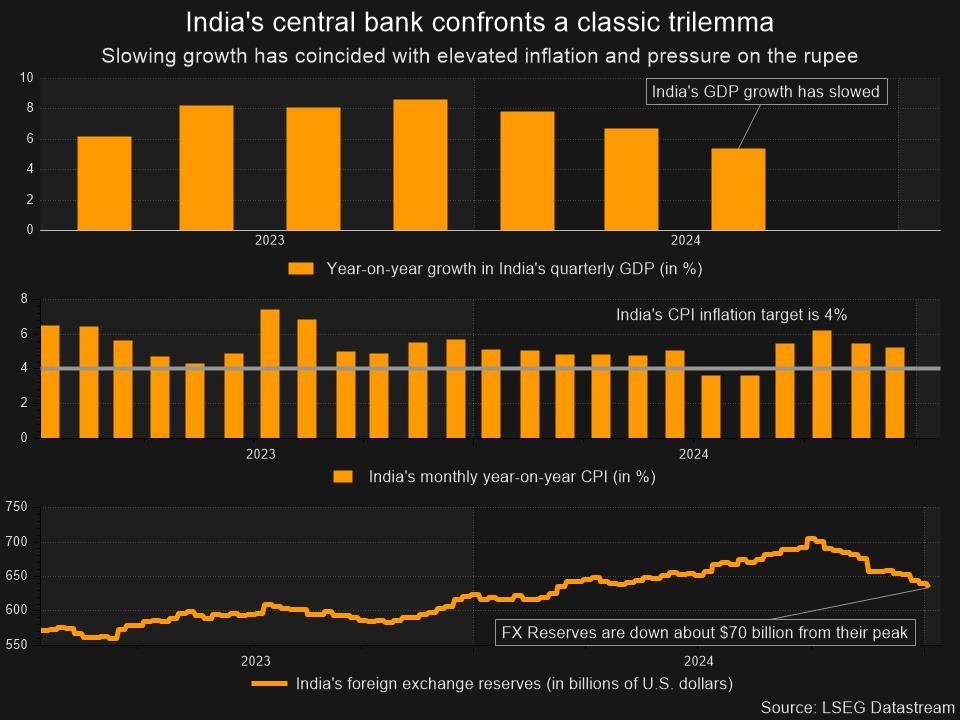

MUMBAI, Jan 15 (Reuters) – Some analysts are pushing back expectations for interest rate cuts in India as the rupee’s slump to record lows fans worries about inflation, even as growth in Asia’s third-largest economy slows.

The weaker currency could add to elevated inflation through costlier imports, while a cut in interest rates could dampen already tepid capital flows, they said.

A majority of analysts polled by Reuters in November had expected Indian rates to be cut in February at the earliest, but the rapid currency slump has prompted many analysts to change their calls. The rate panel next meets on Feb 5-7.

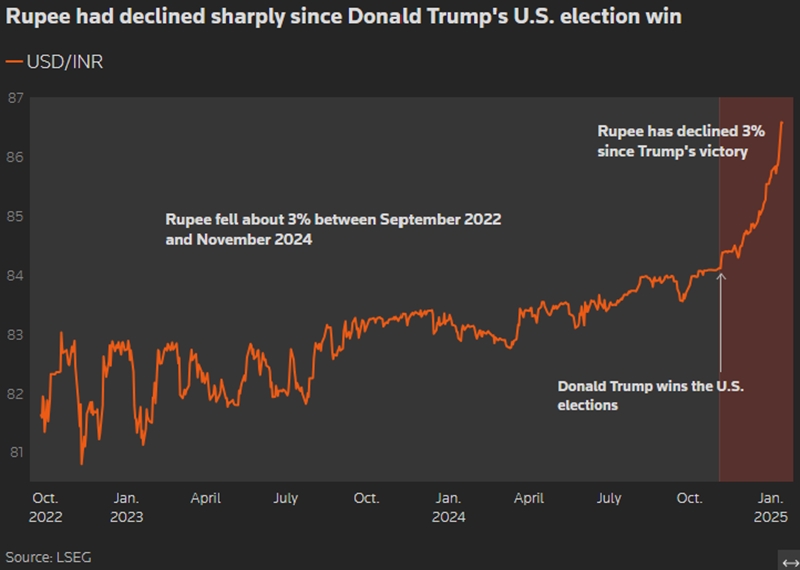

The rupee has lost about 3% of its value against the surging U.S. dollar in a little over two months since Trump’s victory, a sharp contrast to nearly two years of relative stability and muted volatility.

“We push back our call for 50 basis points of repo rate cuts to April-June from February-April,” Standard Chartered said in a note this month, citing external sector volatility as one of the reasons.

According to the Reserve Bank of India’s estimates, a 5% depreciation in the rupee can push up inflation by 35 basis points over several months.

“As the first MPC (monetary policy committee) meeting under the new Governor Sanjay Malhotra comes closer, some doubts have risen over the potential risks to inflation from currency pressures,” said Rahul Bajoria, chief India economist at Bank of America.

Bajoria, however, said that muted underlying demand would prevent a major spillover from a weaker exchange rate into inflation as consumer pricing power remains weak.

“But currency pressures do matter and can have an impact on monetary policy conduct,” he said. “The February MPC remains live for a cut … but FX weakness is creating policy uncertainty.”

Rupee volatility has also been fuelled by the selling of equities and debt by foreign investors in recent weeks.

Overseas investors have pulled out over $4 billion from local stocks and bonds so far this month, adding to the near $11 billion of outflows in the previous quarter, a complete turnaround from the $30 billion worth of buying witnessed between January and September 2024.

Losses in the rupee come despite significant intervention from the RBI, which has seen its foreign exchange reserves fall by around $50 billion in since early November to $634.59 billion as of Jan. 3.

Cutting rates now could further narrow the interest rate differential between India’s benchmark 10-year bond yield and the 10-year U.S. Treasury yield which has dropped to a two-decade low.

“The interest rate differential vs USTs, indeed, makes incremental debt FII inflows difficult,” said Aastha Gudwani, chief India economist at Barclays said. Gudwani expects the central bank to cut rates by 25 basis points in February.

“That said, we believe a cut at this moment will support the growth outlook and likely attract FII equity inflows.”

India forecast annual growth of 6.4% in the year ending in March, the slowest in four years, while December retail inflation eased to a four-month low of 5.22%.

“Allowing the currency to depreciate will add to imported inflation risks, Nomura analysts said in a note this month, adding that they still expect a 25 bps rate cut rates in February.

“If inflation is near target, despite currency weakness, and growth below trend, then we would expect the MPC to support growth.”