NEW DELHI, Feb 1 (Reuters) – Prime Minister Narendra Modi’s government resisted the temptation of spending trillions of rupees on schemes for the poor in its last budget before elections and instead stuck to the path of fiscal consolidation to attract investors.

The lack of social spending largesse is indicative of Modi’s confidence in returning to power for a rare third term on the back of his stratospheric approval ratings, which have been further boosted by the building of a grand Hindu temple on long disputed land.

Tax policies were left unchanged, major subsidies on food, fertiliser and fuel were 8% lower than last year and an allocation for a rural employment scheme was unchanged.

“This is an indication that the ruling BJP (Bharatiya Janata Party) is feeling fairly confident about securing another big victory in the upcoming general election,” said Shilan Shah from Capital Economics.

National elections are due by May this year.

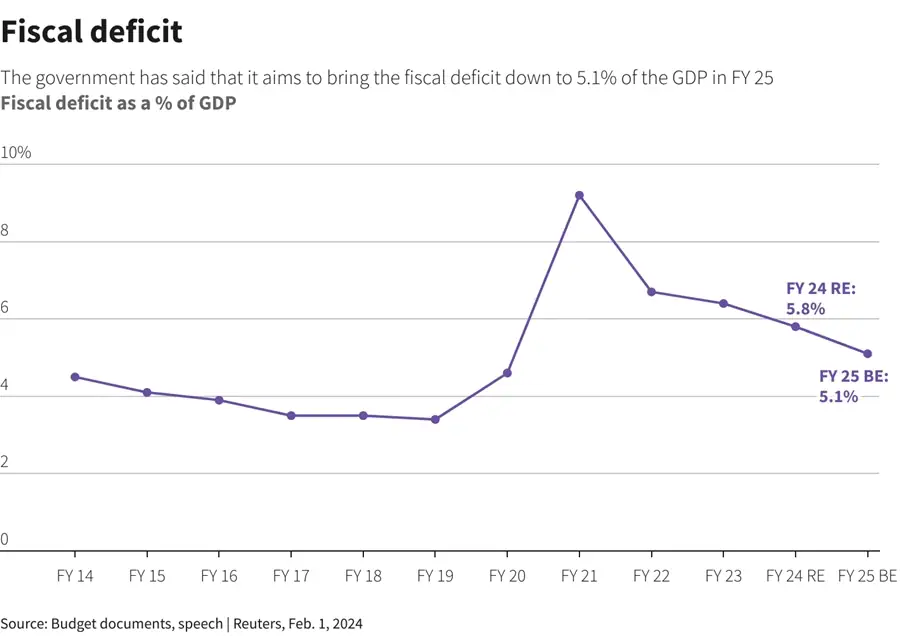

India will reduce its budget gap sharply in 2024-25 to 5.1% of gross domestic product (GDP), Finance Minister Nirmala Sitharaman told parliament on Thursday as she presented the budget, while revising the current fiscal year’s gap lower by 10 basis points to 5.8%.

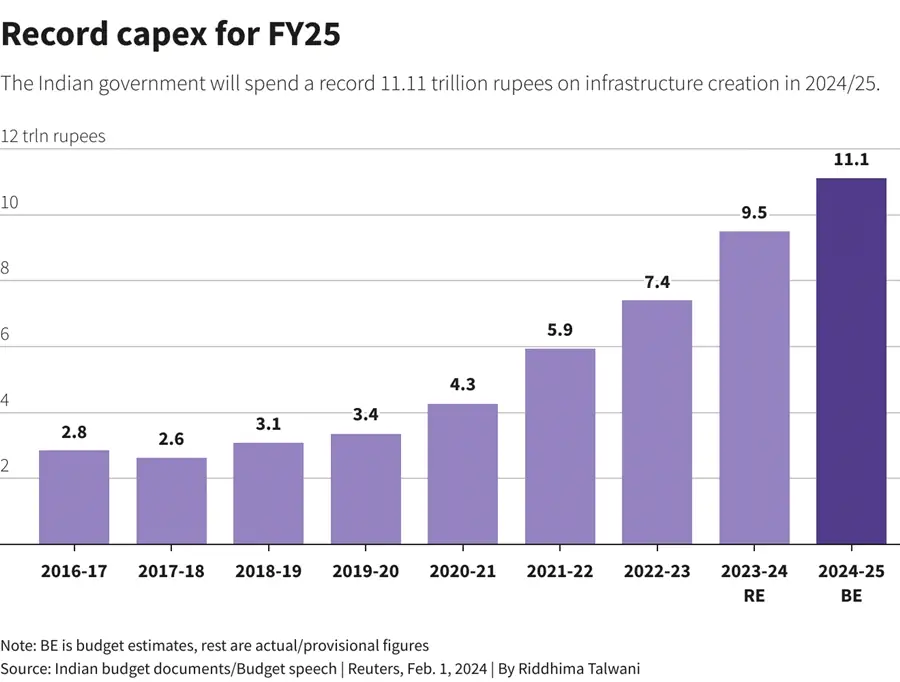

“In this budget, capital expenditure has been raised to a historic high of 11.11 trillion rupees ($133.90 billion), while keeping the fiscal deficit in control. To put it in the terms of economists, this is a sweet spot,” Modi said after the budget presentation.

The fiscal consolidation will help the Indian government to make a stronger case for a higher sovereign credit rating in the coming months, economists said. S&P and Fitch rate India at BBB-, while Moody’s rates the South Asian country at Baa3, the agencies’ lowest investment grades.

“The interim budget effectively juggled the need to support growth while signalling continued fiscal consolidation. This will be reassuring for investors and rating agencies alike,” said Sachchidanand Shukla, economist at Larsen & Toubro.

Over the last three years, the government has stepped up spending on roads, bridges and other infrastructure as a way to boost the economy and create jobs.

The budget foresees an increase in capital expenditure on such long term projects by another 11% over last year, even as the government’s overall spending rises at a slower 6%.

The pace of increase in capital spending is lower than in the previous year.

The federal government will also provide 1.3 trillion rupees in long term loans to states to spend on infrastructure.

There are weak spots in the economy, though.

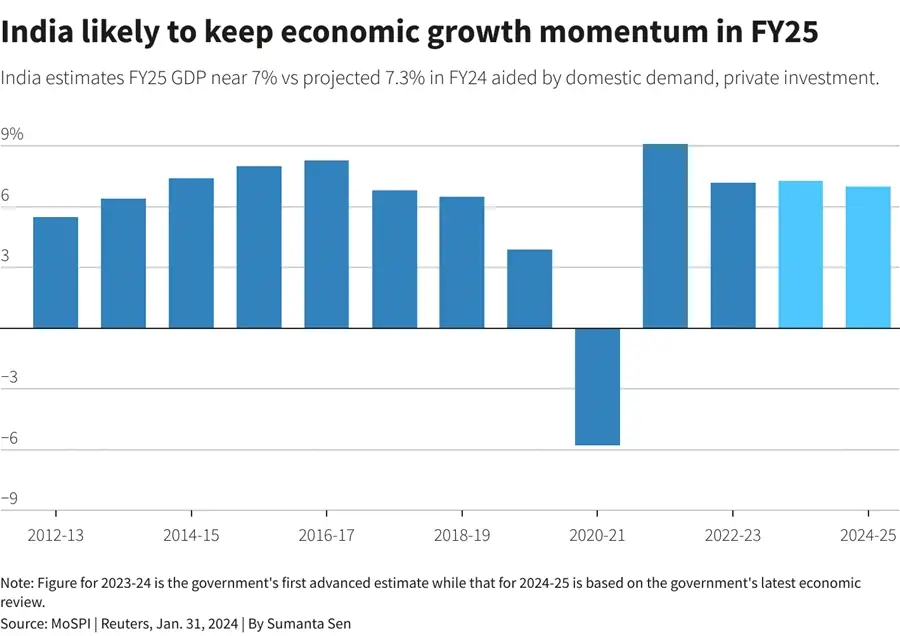

While India’s economic growth is expected to notch a record-beating 7.3% pace for the financial year ending March 31, 2024, consumption – which accounts for close to 60% of GDP – has remained weak, with growth at just over 4%.

Weak growth in wages and high inflation has hurt lower income earners, particularly in rural areas, impacting their ability to spend on even items of daily use.

“The budget lacks consumption triggers. Thus, it is a departure from the previous pre-election vote on accounts,” said Garima Kapoor, economist at Elara Capital.

Finance Minister Sitharaman said the government will build 20 million affordable houses in the next five years, to add to the 30 million houses built already.

The government will also launch a scheme for housing for the middle class, she said, without providing details.

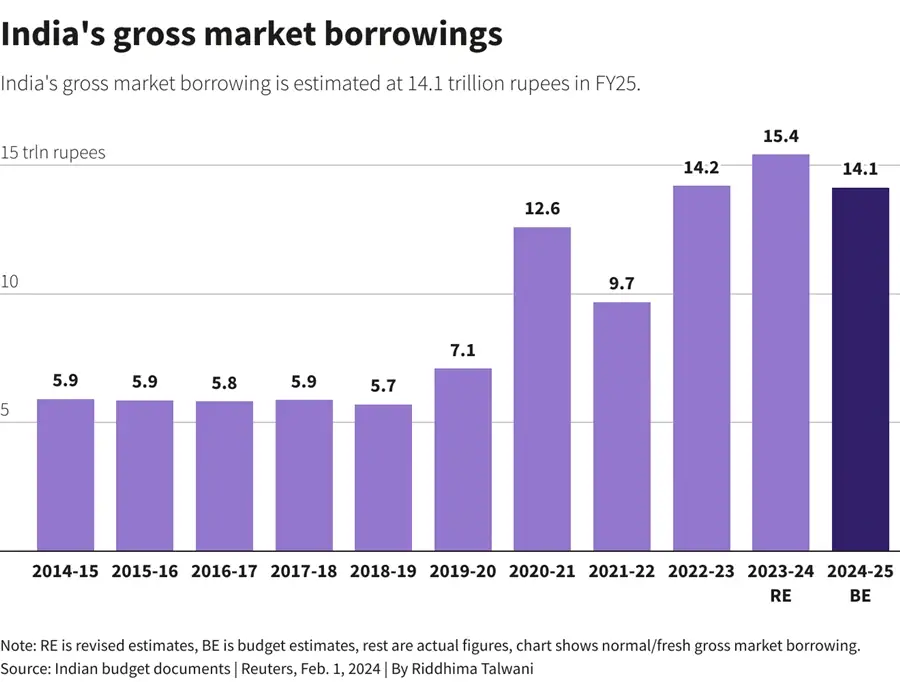

The government will borrow a lower-than-expected 14.13 trillion Indian rupees ($170.33 billion) from the bond markets to fund its fiscal deficit.

The budget had little impact on the country’s equity and currency markets, but a better than expected fiscal deficit target and lower than estimated borrowing boosted gains in bonds.

Equity markets wavered between gains and losses, with both the benchmark BSE Index (.BSESN), opens new tab as well as wider NSE Nifty 50 index trading little changed, but off their days highs.

The Indian benchmark 10-year bond yield dropped to over six-month lows,.

The yield was at 7.0467%, as of 1:55 p.m., against 7.1267% before the budget announcement. The Indian rupee pared gains after briefly rising to 82.9325 to the U.S. dollar compared with 82.9800 before the budget.

($1 = 82.9575 Indian rupees)

($1 = 82.9750 Indian rupees)