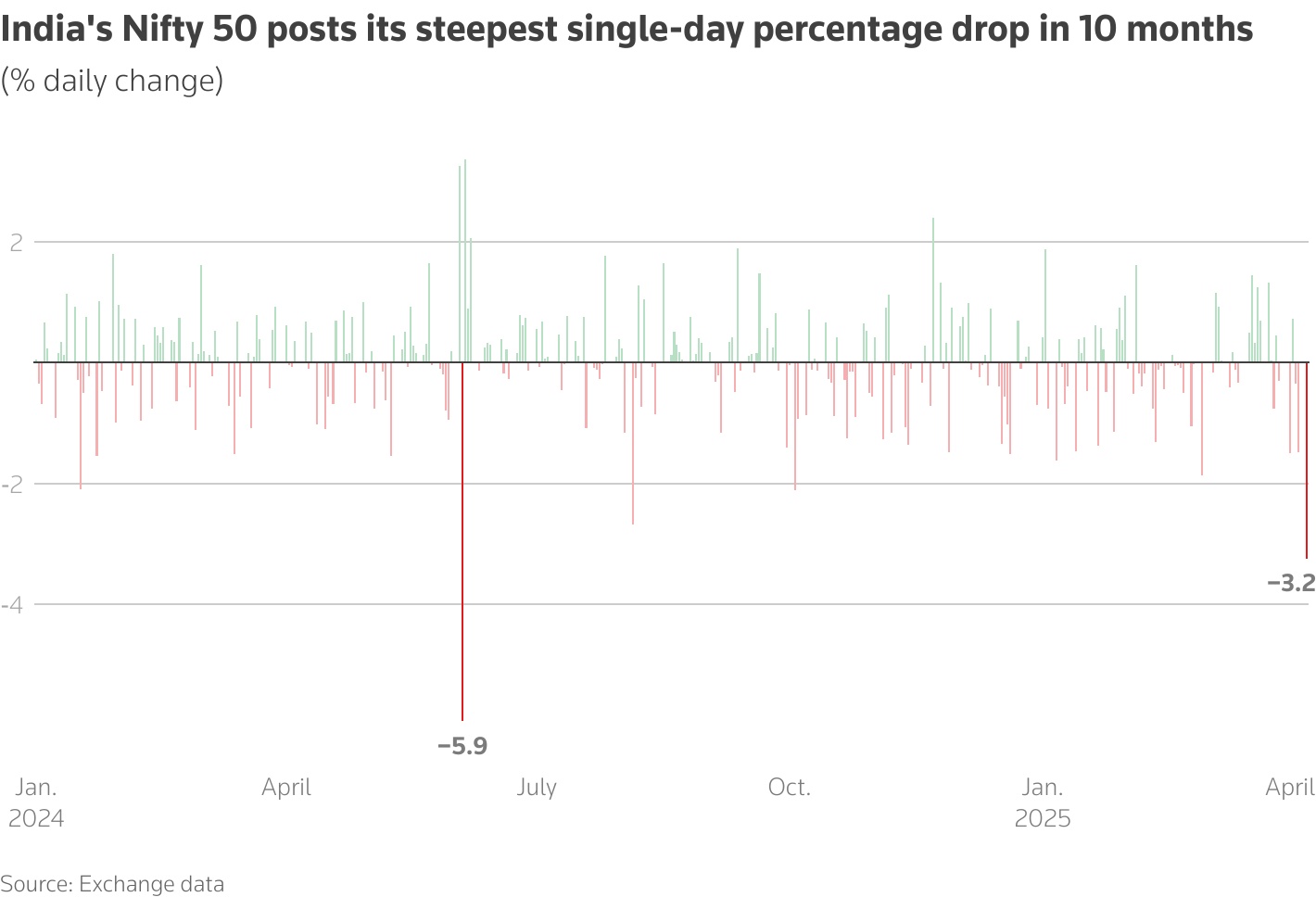

April 7 (Reuters) – India’s stock benchmarks clocked their worst session in 10 months on Monday as a tariff-fueled selloff intensified and investors dumped riskier assets on growing fears of a global recession.

The Nifty 50 lost 3.24% to 22,161.1 while the BSE Sensex fell 2.95% to 73,137.9. Both benchmarks posted their worst single-day decline since June 4, 2024.

Other global markets slumped, with the MSCI Asia ex-Japan index losing 8.3%. Japan’s Nikkei 225 dropped 7.8%, while European stocks plunged with Germany’s Dax falling 5.3% and the British FTSE shedding 4.1%.

President Donald Trump’s new tariffs are “larger than expected” and are likely to impact inflation and growth, Federal Reserve Chair Jerome Powell said on Friday, flagging an uncertain outlook for the U.S. economy.

S&P 500 futures slid nearly 5% in volatile trade on Monday, while Nasdaq futures dived 5.7%, adding to last week’s almost $6 trillion in market losses.

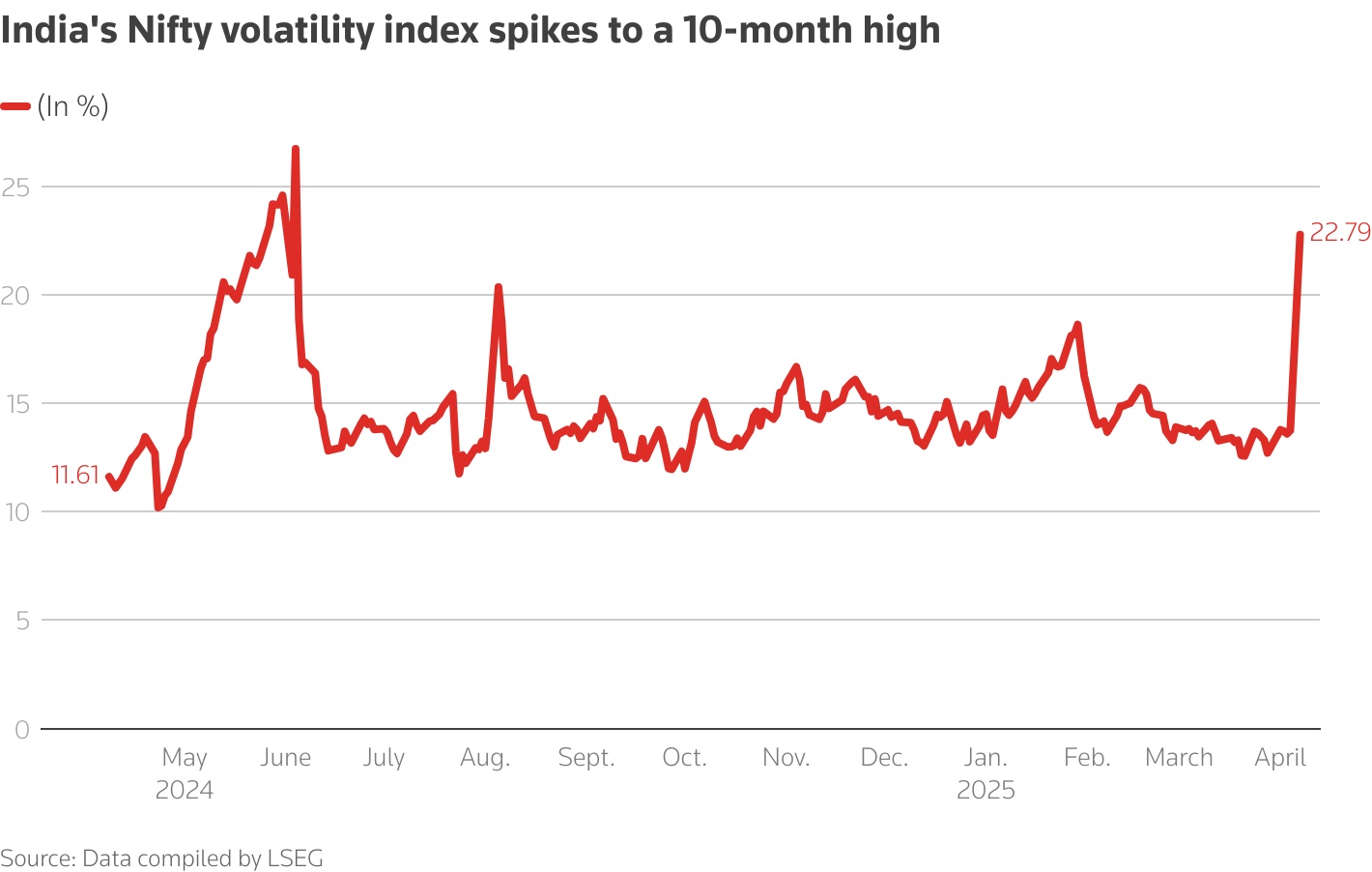

The Nifty volatility index – or the fear index – rose 66%, the most in a session in 10 years to 22.79, and the highest since June 5, 2024.

“The sell-off on Monday is sentiment-driven, exacerbated by fears of a prolonged trade war and global liquidity tightening,” said Jaspreet Singh Arora, CIO at Equentis Wealth Advisory Services.

IT and export-driven sectors may stay under pressure in the near term due to trade tensions, Arora said.

Analysts cautioned that declining returns and increased volatility could diminish the appeal of domestic equities. Multiple brokerages also expect a downside risk to India’s fiscal year 2026 GDP growth due to the tariffs.

However, India does not see any hit to projected growth for the fiscal, government officials said on Monday.

All 13 major sectors declined on the day.

IT companies, which earn a significant share of their revenue from the U.S., lost 2.5%.

With tariffs and trade wars, some of the discretionary spending in IT could get pushed out, triggering a fall in the sector, said Shibani Kurian, senior fund manager and head of equity research at Kotak Mutual Fund, told Reuters Trading India.

Private lenders HDFC Bank, ICICI Bank and oil-to-telecom conglomerate Reliance Industries – the three heaviest stocks that have a 32% weightage in the Nifty 50 – lost about 3.5% each.

The broader small-caps and mid-caps fell 3.9% and 3.6%, respectively, their worst session in nearly three months.

Among stocks, retailer Trent tumbled 15% on slowing revenue growth, while Tata Motors slid 5.6% after its luxury arm Jaguar Land Rover paused exports to the U.S.