MUMBAI, Nov 1 (Reuters) – The Indian rupee is likely to break out of rangebound trade, as the Reserve Bank of India’s defence of the currency will be unsustainable at some point of time, traders said.

The rupee was at 83.27 against the U.S. dollar at 11:08 a.m. IST, slightly weaker than 83.25 in the previous session.

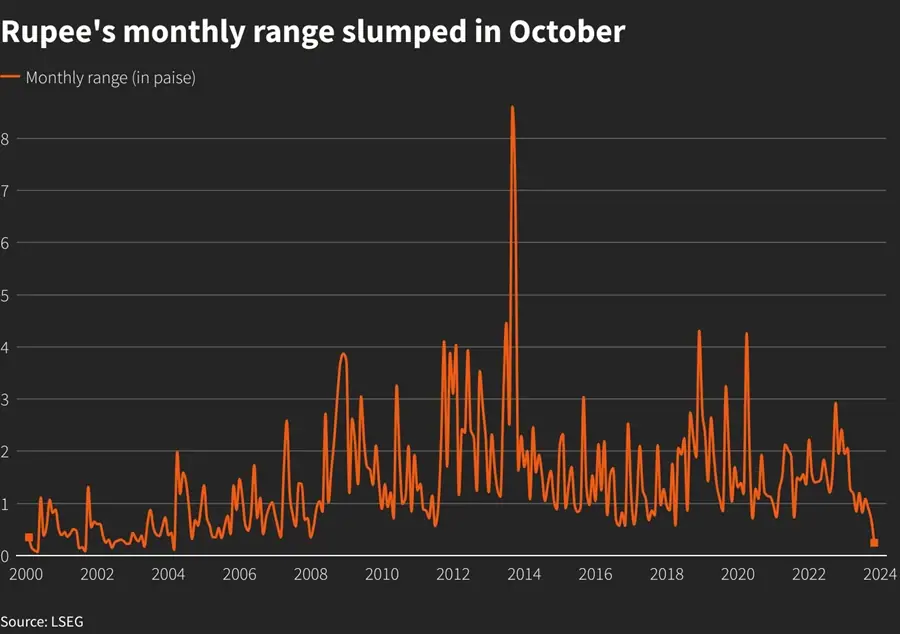

The rupee’s monthly range narrowed last month despite persistent local dollar demand and equity outflows, as the central bank’s forex market interventions prevented a breach of the 83.29 record low.

The spike in U.S. Treasury yields and global risk aversion due to the military conflict in the Middle East also could not hurt the rupee much.

A repeat of what happened in October is not likely, bankers said.

The prevailing narrow range for the rupee is unlikely to hold, said Apurva Swarup, vice president at Shinhan Bank India.

“Eventually the RBI will have to stop,” as the current approach is unsustainable in the long term, he said.

Volatility expectations for the rupee have dropped. One-month implied volatility eased to a multi-year low of 2.45% on Wednesday.

“It’s advisable to fasten your seatbelt and prepare for a potential ride into higher volatility,” said Amit Parbari, managing director at forex advisory firm CR Forex.

On Wednesday, most Asian units fell before the U.S. Federal Reserve policy outcome due later in the day.

The dollar index was higher at 106.75 and the 10-year U.S. Treasury yield rose.

The Fed is widely expected to make no change to the policy rate.

Investors will focus on Fed Chair Jerome Powell’s press conference for cues on whether another rate rise may be in the offing.