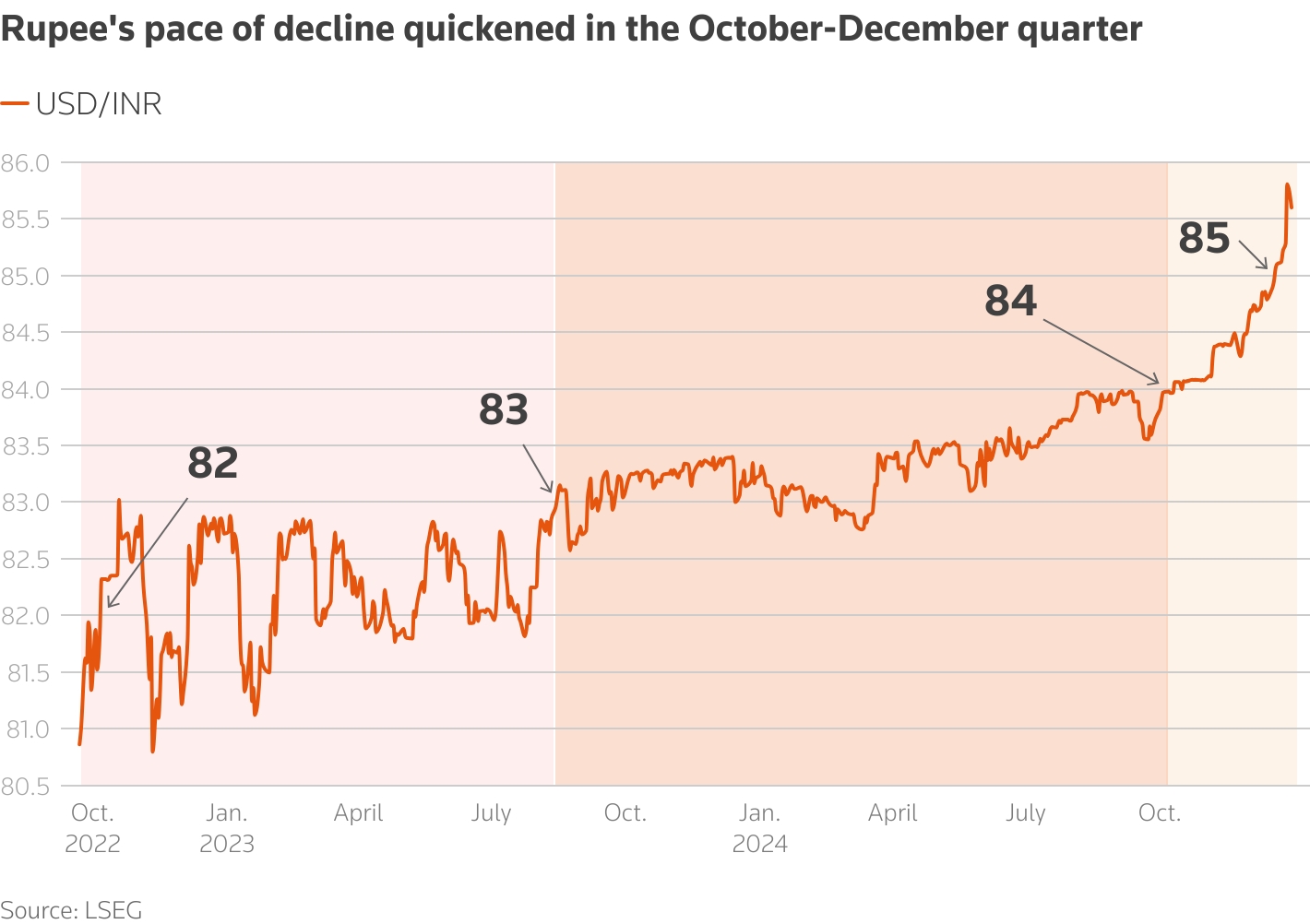

MUMBAI, Dec 31 (Reuters) – The Indian rupee fell for a seventh straight year in 2024, largely due to headwinds in the last quarter, including Donald Trump’s U.S. election victory-spurred surge in the dollar, while locally, slowing growth and a wider trade deficit weighed.

The rupee dropped 2.8% in 2024 to end the year at 85.6150 per U.S. dollar. It fared better than many of its Asian peers, which declined between 3% and 12% due to the dollar’s strength and multiple twists and turns in the outlook on U.S. policy rates.

The rupee was only marginally weaker at the end of September. But it slid nearly 2.2% in the last quarter and hit multiple record lows, with the lifetime low of 85.8075 coming on Dec. 27.

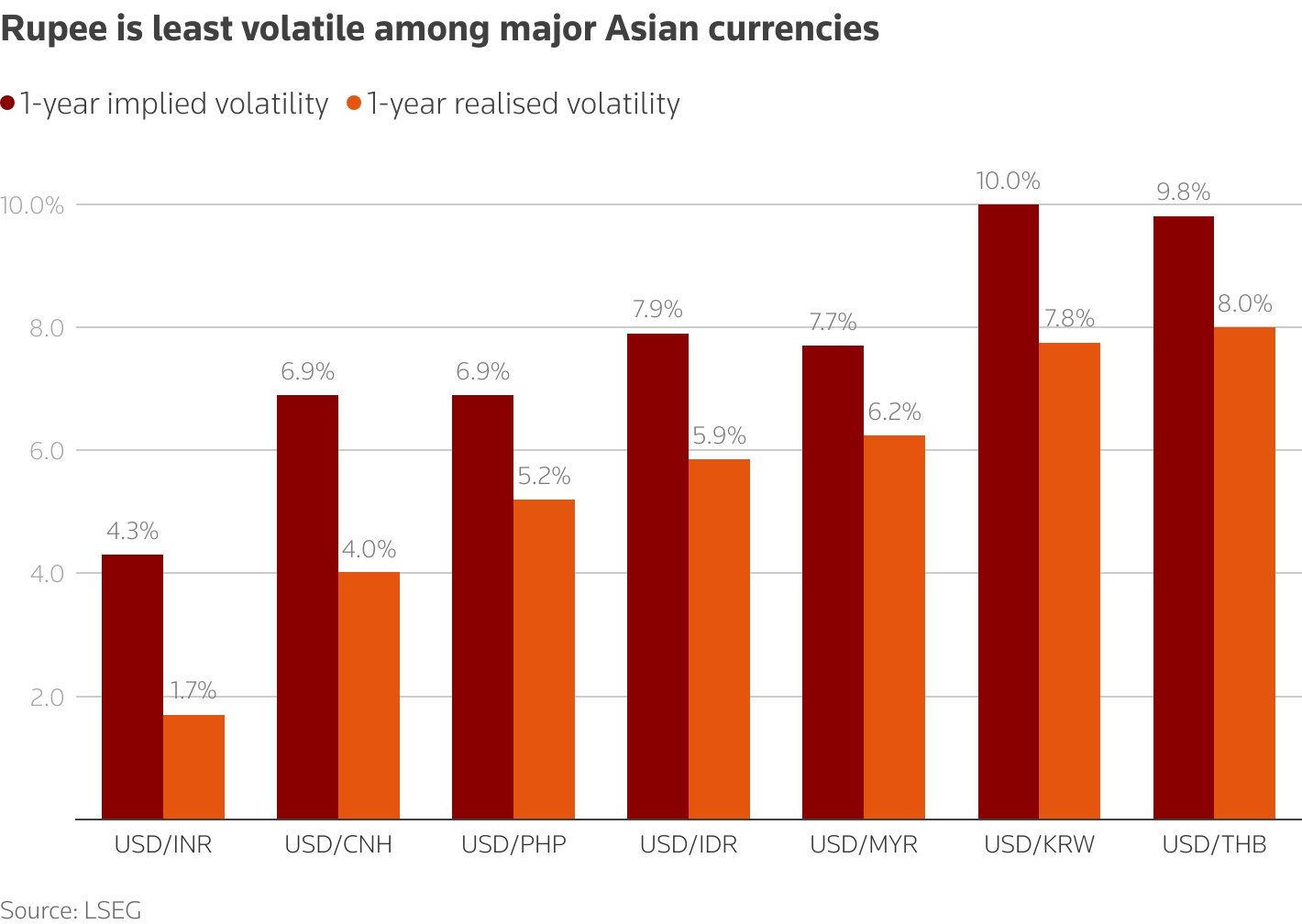

Despite the rupee’s struggles in the last three months, it remains the least volatile major Asian currency, excluding the pegged Hong Kong dollar, largely due to the Reserve Bank of India’s routine two-sided interventions.

When portfolio inflows jumped in the July-September quarter, the rupee benefited only marginally as the central bank absorbed dollar inflows, lifting the country’s forex reserves (INFXR=ECI), opens new tab to an all-time high of $704.89 billion.

On the other hand, RBI has routinely stepped in to sell dollars to support the rupee when emerging market currencies struggled due to tensions emanating from the Middle East or uncertainty over the Federal Reserve’s outlook. Trump’s election victory in November kept the RBI busy.

The RBI’s efforts to manage the rupee were challenged in the December quarter by developments at home — India’s growth rate dipped, the trade deficit widened and foreigners pressed the sell button on equities.

Foreigners have taken out $11.7 billion from Indian equities in the December quarter, compared with inflows of about $12 billion in the first nine months.

And as the rupee slid, the forex reserves reflect the RBI’s efforts to support the currency. India’s forex reserves are now down $60.5 billion from their record-high levels.

“We expect INR depreciation to persist in 2025. RBI may change its intervention policy as INR seems overvalued … along with large reserves already used up in current year,” said Anshul Chandak, head of treasury at RBL Bank.

In 2025, traders will keep an eye on potential U.S. trade tariffs which may dampen the outlook for emerging market currencies, especially the Chinese yuan.

India’s growth trajectory will be the other key variable alongside any potential changes in RBI’s forex strategies under the new governor.