May 7 (Reuters) – Gold prices fell on Wednesday as optimism over potential U.S.-China trade talks weakened demand for safe-haven assets, while investors braced for the Federal Reserve’s policy decision due later in the day.

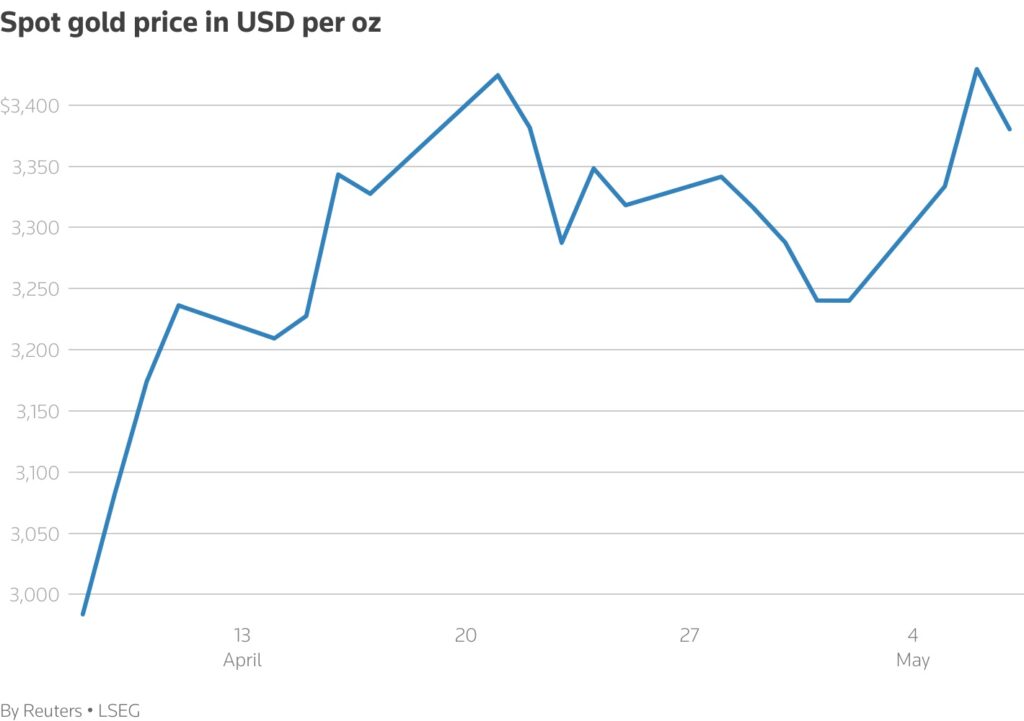

Spot gold was down 1.3% at $3,383.88 an ounce, as of 0432 GMT. The metal climbed nearly 3% in the previous session.

U.S. gold futures fell about 1% to $3,391.80.

“Gold seems to be pulling back amid a broad-based “risk on” move across markets … this is a pro-cyclical configuration that might echo optimism amid clues that the U.S. and China have started real trade negotiations,” said Ilya Spivak, head of global macro at Tastylive. GLOB/MKTS

U.S. Treasury Secretary Scott Bessent and chief trade negotiator Jamieson Greer will meet top Chinese economic official He Lifeng in Switzerland this weekend for talks.

Both countries imposed tit-for-tat tariffs last month, triggering a trade war that fuelled fears of a global recession.

On Tuesday, U.S. President Donald Trump said he and top administration officials will review potential trade deals over the next two weeks to decide which ones to accept.

The market’s focus will also be on the Federal Open Market Committee (FOMC) meeting later in the day, where the U.S. central bank is expected to hold interest rates steady.

The FOMC will remain vague to keep as much flexibility as possible as it tries to discern what this trade war will mean for growth and inflation, Spivak added.

Traders are expecting rate cuts of 80 basis points this year, starting in July.

Fed Chair Jerome Powell’s remarks are also awaited for clues into the potential timing of future rate reductions.

Gold, traditionally seen as a hedge against economic and political uncertainties, thrives in a low-interest rate environment.

On the geopolitical front, India said it attacked Pakistan early following a deadly attack on tourists in Kashmir last month. Pakistan reported eight deaths and said it was responding to the Indian strikes.

Spot silver eased 0.7% to $33.01 an ounce, platinum dipped 0.1% to $983.60 and palladium lost 0.7% to $967.64.