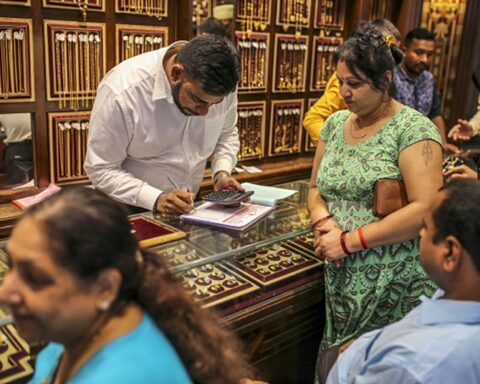

March 13 (Reuters) – Gold prices edged higher on Thursday as uncertainty over tariffs persisted, driving safe-haven demand, while a cooler-than-expected U.S. inflation print also supported bullion by strengthening expectations of rate cuts.

Spot gold was up 0.4% at $2,943.66 an ounce, as of 0300 GMT, while U.S. gold futures firmed 0.2% to$2,951.90.

Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here.

“I think $3,000 is the next logical target, likely reached sometime over the next several months,” said Marex analyst Edward Meir. “CPI data was encouraging but I suspect that the tariff increase has yet to be picked up in the inflation data.”

Data showed that the U.S. consumer price index increased less than expected last month, but the improvement is likely temporary against the backdrop of aggressive tariffs on imports that are expected to raise the cost of most goods in the months ahead.

Lower inflation leaves more room for the U.S. Federal Reserve to cut interest rates, and non-yielding gold thrives in a low-interest rate setting.

Trump early this month triggered a trade war, increasing the tariffs on goods from China to 20% and imposing a new 25% duty on Canadian and Mexican imports.

He later dialled back and provided a one month exemption for any goods that meet the rules of origin under the U.S.-Mexico-Canada Agreement on trade.

Trump also reversed course on Tuesday afternoon on a pledge to double tariffs on steel and aluminum from Canada to 50%, hours after announcing the higher tariffs.

Trump’s tariffs are widely expected to stoke inflation and economic uncertainty, and have prompted safe-haven gold to reach a record high of $2,956.15 on February 24.

Investors now await U.S. Producer Price Index (PPI) data due later in the day to gain further insights into the Fed’s monetary policy.