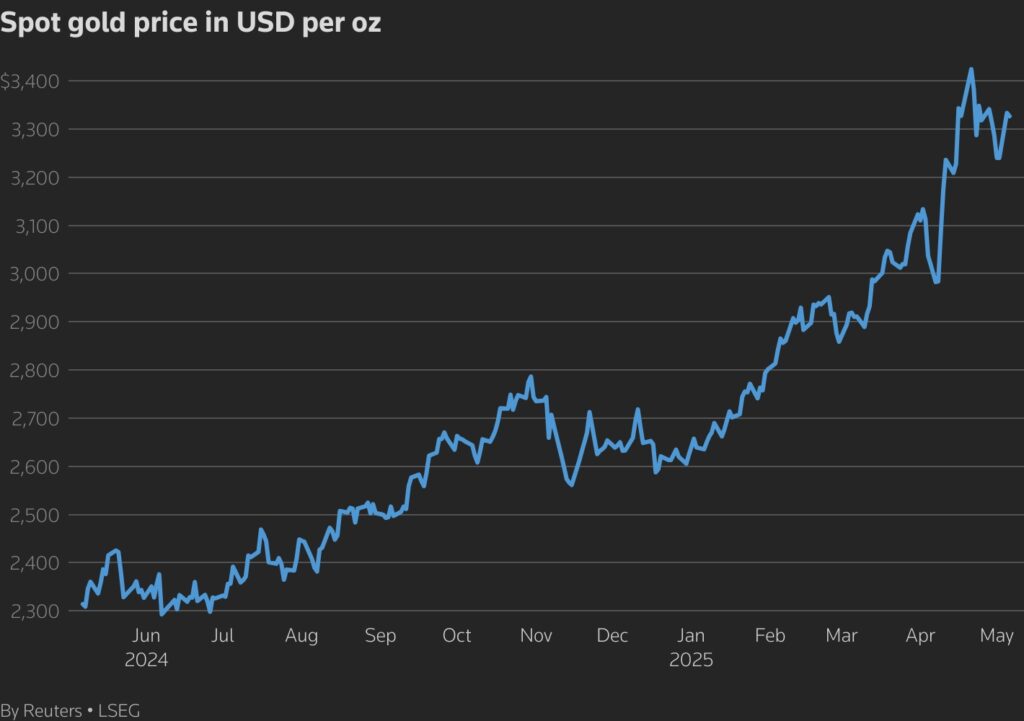

May 6 (Reuters) – Gold prices rose to a two-week high on Tuesday as concerns over U.S. President Donald Trump’s tariff plans boosted interest in the safe-haven metal, while investors awaited the upcoming Federal Reserve policy meeting.

Spot gold was up 0.7% at $3,357.63 an ounce, as of 0410 GMT, after hitting its highest level since April 22 earlier in the session.

U.S. gold futures climbed 1.3% to $3,366.10.

“Gold prices have a strong run-up to start this week, with investors returning to the safe-haven asset to hedge against portfolio volatility amid renewed tariff concerns from U.S. President Donald Trump,” said IG market strategist Yeap Jun Rong.

Trump announced on Sunday a 100% tariff on movies produced overseas, but issued few details on just how such a levy would work.

On Monday, he said he intends to announce pharmaceutical tariffs within the next two weeks.

On the radar this week is the Fed’s interest rate decision and Fed Chair Jerome Powell’s comments due on Wednesday to get clues on the U.S. central bank’s rate trajectory. The Fed has held its policy rate in the 4.25% to 4.50% range since last December.

“Any dovish signals could provide further support for gold, reinforcing its broader upward momentum,” Rong said.

The Fed will doubtless leave interest rates unchanged, according to a Reuters report, which also mentioned that the meeting may be the last where the outcome is so cut and dry with Trump’s tariffs casting a shadow of uncertainty over the economic outlook.

“Fed officials will want to see evidence from labor market and other hard data before cutting. We think this will take a couple of months and therefore expect three 25bp cuts in July, September, and October,” Goldman Sachs said in a note.

Non-yielding bullion, a safeguard against political and financial turmoil, thrives in a low-interest-rate environment.

Among other metals, spot silver rose 1.7% to $33.05 an ounce, platinum climbed 1.5% to $973.20 and palladium advanced 1% to $950.66.

Except for the picture, this story has not been edited by The Sen Times staff and has been published from a syndicated feed.