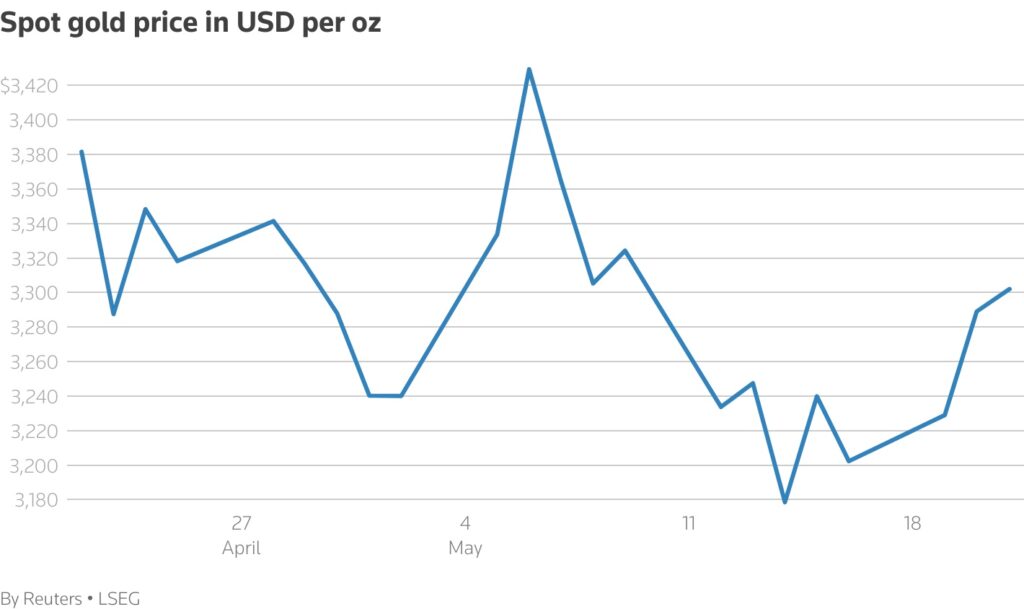

May 21 (Reuters) – Gold prices rose on Wednesday to their highest in more than a week as the dollar weakened and investors sought safety amid U.S. fiscal uncertainty, with Congress debating a sweeping tax bill.

Spot gold was up 0.5% at $3,305.39 an ounce by 0408 GMT, after hitting its highest level since May 12 earlier in the session.

U.S. gold futures gained 0.7% to $3,307.30.

The dollar retreated to its lowest since May 7, making greenback-priced gold cheaper for holders of overseas currency.

“The general dollar index lost more than a full point in the last 24 hours as the Moody’s downgrade, plus skepticism about trumps tax bill continues to undermine the dollar,” which is positive for gold, said Marex analyst Edward Meir.

Trump on Tuesday pressed his fellow Republicans in the U.S. Congress to unite behind a sweeping tax-cut bill, but apparently failed to convince a handful of holdouts who could still block a package that encompasses much of his domestic agenda.

Gold, traditionally considered a safe-haven asset during political and economic uncertainty, tends to thrive in a low-rate environment.

“Over the medium- to longer-term, further upside in gold is favoured, though if any positive trade-deal headlines arise this could be an obstacle for gold in attempting to reclaim the $3,500 level,” said KCM Trade Chief Market Analyst Tim Waterer.

St. Louis Fed President Alberto Musalem told the Economic Club of Minnesota that easing trade tensions would allow the labor market to stay strong and inflation to remain on path to the Fed’s 2% goal.

Spot Palladium fell 1.2% to $1,001.41, but hit its highest level since February 4, earlier in the session.

“Palladium has been starved for good news… Honda moving more towards hybrids and not EV is a decent reason” said Tai Wong, an independent metals trader.

Both platinum and palladium are used by automakers in catalytic converters to reduce exhaust emissions.

Silver fell 0.1% to $33.03 an ounce, platinum was down 0.7% at $1,046.70.