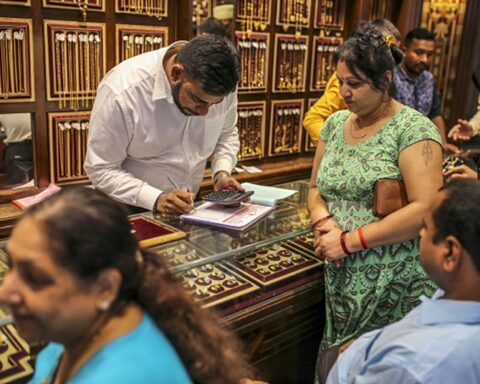

Mumbai, Apr 23 (PTI) High gold prices, which crossed Rs 1 lakh per 10 grams in spot markets, are likely to hit demand in the short term but the market sentiment remains positive due to upcoming key events like Akshya Tritiya and ongoing marriage season buying, say experts..

Gold price of 24-karat variety (999 fineness) traded at Rs 101,350 per 10 grams in the Mumbai bullion market while 22 karat gold was quoted at Rs 92,900 per 10 grams on Tuesday.

“The sudden rise in gold price will definitely have an impact on demand, however, when the shock gets absorbed then the demand will stabilise. Overall, there is a positive sentiment in the market and we expect good consumer demand following the upcoming Akshya Tritiya and the ongoing wedding season,” All India Gem And Jewellery Domestic Council chairman Rajesh Rokde told a news agnecy.

He said, this can be analysed by imports data of 2023 and 2024.

“In 2023 gold imports were 741 tonnes while in 2024 it was 802 tonnes, which reflects demand, even as the gold price was higher by 25-30 per cent. The gold price difference was 25-20 per cent. We found that even as the gold prices were more volatile in 2024, the demand was also higher than the previous year,” Rokde added.

PN Gadgil Jewellers chairman Saurabh Gadgil said that there is a lot of optimism in the market and that there are also expectations that the gold prices will rise further in the future.

Talking about demand, he said, volumes have been under pressure for some time due to the continuing rise in gold prices, however, the consumer sentiment is positive which will be good for the industry.

All India Gem And Jewellery Domestic Council vice chairman Avinash Gupta said gold prices crossing over Rs 1 lakh per 10 grams with GST (goods and services tax) will definitely have some impact on demand in terms of volume.

“However, we are expecting the impact to be around 10-15 per cent as there is a positive sentiment among the consumers due to the upcoming Akshay Tritiya and the ongoing wedding season, which is expected to go on till June,” he added.

Gold prices have been rising constantly and consumers are adjusted to the rise in prices and expect these to rise further, he added.

Kama Jewelry MD Colin Shah said, the new all-time-high attained by the yellow metal is primarily influenced by the rising tensions between US President Donald Trump and US Fed Chair Jerome Powell regarding the Fed rate cut.

Additionally, weakness in the US dollar and uncertainties around the US-China trade war are other crucial factors that have pushed gold prices to a record high.

“While the investors will make the most out of this price hike to invest in gold to provide a hedge to their portfolio against inflation, the consumer sentiment is bound to take a hit following this upward price trajectory. However, this will be gradually absorbed by the domestic buyers in the long run,” Shah added.