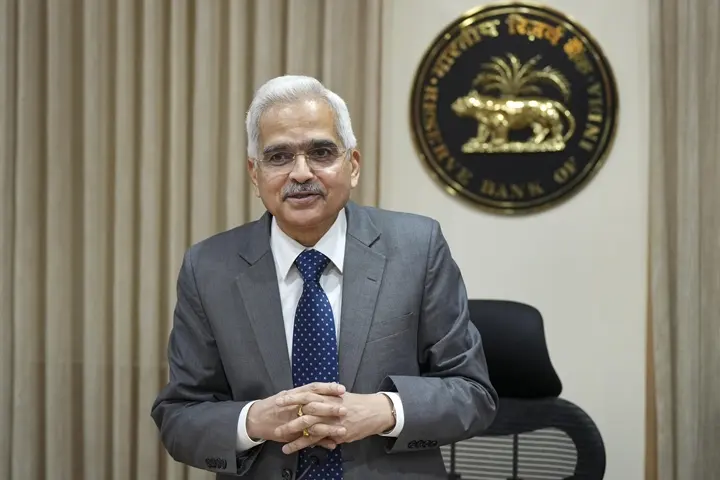

Mumbai, Sep 4 (PTI): Reserve Bank Governor Shaktikanta Das on Monday said faster, transparent and more inclusive payment services will deliver widespread benefits as he flagged concerns over high cost and slow cross-border payments.

”Notwithstanding the progress made so far, the key challenges to the existing cross-border payment systems continue to be high cost, low speed, limited access and insufficient transparency. Faster, cheaper, more transparent and more inclusive cross-border payment services would deliver widespread benefits to people and economies worldwide.

”It would also support economic growth, international trade and financial inclusion,” Das said at the concluding session of the G20 TechSprint here this evening, organised by the Reserve Bank and the Bank for International Settlements.

The G20 TechSprint was launched in May 2023 with the theme ‘technology solutions for cross-border payments’ under India’s presidency of the grouping of the 20 world’s largest economies. The final session of the presidency is slated for later this week in the national capital.

The G20 TechSprint is a global long-form hackathon series that the BIS Innovation Hub co-hosts annually with the G20 presidency to identify new technologies that can address the challenges and priorities of central banks. The governor also suggested that central bank digital currencies (CBDCs) can play an important role in making cross-border payments cheaper, faster and more secure.

Noting that several central banks across the world are considering the introduction of CBDCs and are taking steps in this direction, he said India is one of the few countries that has launched CBDC pilots in wholesale and retail segments.

”Slowly and steadily, we are expanding the pilot to more banks, more cities, more people and more use cases. The empirical data that we are generating would go a long way in shaping the policies and future course of action. With its instant settlement feature, CBDCs can play an important role in making cross-border payments cheaper, faster and more secure,” he said.

This report is generated from PTI news service. The Sen Times holds no responsibility for its content.