New Delhi, May 28 (PTI) Flagging a reported drop in the share of passenger cars in the overall auto sales, the Congress on Wednesday claimed that it points to most Indians being locked out of the consumption economy, growing inequality, stagnant incomes and weak investment.

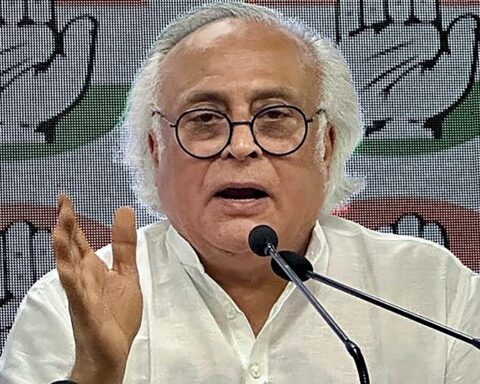

Congress general secretary in-charge of Communications Jairam Ramesh shared a media report which claimed that while the middle class is increasingly unable to transition from two-wheelers to entry-level cars, the sport utility vehicle (SUV) segment is recording a rising share of first-time buyers.

There was no immediate response from the government or the BJP.

“India Inc is raising the siren once again — this time for auto sales. In 2018-19, passenger cars made up 65% of total sales of vehicles — that share is now only 31%. SUVs and multi-purpose vehicles now account for 65% of sales,” Ramesh said in a post on X.

Noting that car sales have long been considered an indicator of the economy’s health, Ramesh said the last few years have seen a ‘decoupling’ of the two with medium GDP growth accompanied by concerningly low growth in car sales.

“Buyers are increasingly turning towards the used car market. Auto manufacturers are now producing with an eye on export markets rather than domestic markets,” he claimed on X.

“What does this say about the state of the economy? Most Indians are locked out of the consumption economy — about 88% of Indian households earn less than Rs 12 lakh annually,” Ramesh said.

Alleging “growing inequality”, Ramesh said the surging sales of expensive SUVs compared to the stagnant sales of passenger cars points to the elite gaining a disproportionate share of the economy’s growth.

He alleged that there was “pernicious inequality” with most lower and middle-income consumers stuck in their current income segments and unable to rise out of them.

On the issue of “stagnant” incomes, Ramesh said the auto sales figures also reflect that the lower and middle classes are seeing their incomes stagnating amidst medium to high inflation.

He claimed that it also showed weak investment.

“Weak consumption in the domestic economy means manufacturers have no incentive to set up new factories or create new capacity for domestic markets,” Ramesh said.

In another post, Ramesh claimed that investment by Indian companies in India is not picking up due to weak consumption growth.

“A decade of stagnant wages across various sectors in the economy – ranging from rural agricultural to the salaried white collar classes – has meant that there is no discretionary income available for India’s families to purchase more. Without consumption demand, corporate India has no systematic incentive to invest,” he said.

He alleged that domestic investment by Indian companies is not picking up due to “tax terrorism”.

“The atmosphere of fear and intimidation – as evinced by the manner in which 41 corporate groups have faced a total of 56 ED/CBI/IT raids and were effectively forced to give Rs. 2,592 crore to the BJP through the illegitimate Electoral Bonds Scheme,” he charged.

He also complained of a ” horribly complicated GST system which is crying out for reform”. In a swipe at the BJP-led government, he said “increasing disenchantment with Maximum Theatrics, Minimum Governance” was also a reason for investment not picking up.