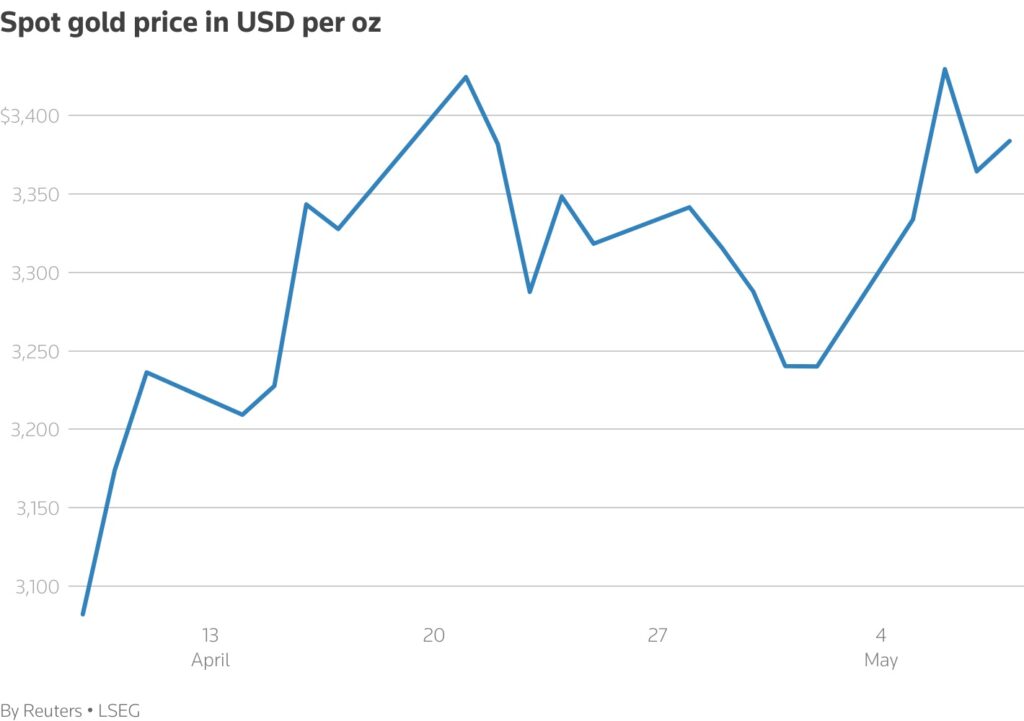

May 8 (Reuters) – Gold climbed on Thursday after the Federal Reserve warned of rising inflation and labor market risks fuelling economic uncertainty, while investors awaited the outcome of the U.S.-China trade talks this weekend.

Spot gold rose 0.9% to $3,392.90 an ounce, as of 0416 GMT. U.S. gold futures firmed 0.2% to $3,399.80.

“The focus in the yellow market was on the statements from the Fed, as they left rates unchanged but flagged risk of higher inflation and unemployment,” said Reliance Securities’ senior commodity analyst Jigar Trivedi.

The Fed held interest rates steady on Wednesday but said risks of higher inflation and unemployment had risen, as its policymakers grapple with the impact of President Donald Trump’s tariffs.

Trump suggested China initiated the upcoming senior-level trade talks between the two countries and said he was not willing to cut import tariffs on Chinese goods to get Beijing to the negotiating table.

“The hotter rhetoric from Trump about trade negotiations with China”, is also helping the market sentiment, Capital.com’s financial market analyst Kyle Rodda said.

“It taps into two key themes which are slower U.S. growth and de-dollarisation.”

Trump is expected to announce a trade deal between the U.S. and Britain on Thursday, the New York Times reported.

The non-yielding bullion, a safeguard against political and financial turmoils, thrives in a low-interest-rate environment.

Elsewhere, India struck Pakistan and Pakistani Kashmir on Wednesday over the tourist killings in Kashmir last month. Pakistan vowed to retaliate and said it shot down five Indian aircraft.

“If (tension) further escalates…then we might see gold continue to rise and maybe break the previous high that we’ve seen,” said Brian Lan, managing director, GoldSilver Central, Singapore.

Bullion hit a record high of $3500.05 on April 22.

Spot silver rose 1.2% to $32.85 an ounce, platinum gained 0.9% to $982.81 and palladium fell 0.3% to $969.93.