Feb 11 (Reuters) – Indian stocks have lost about $180 billion in market value in the two days since U.S. President Donald Trump said he would slap reciprocal tariffs on several countries, with many analysts saying the world’s fifth-largest economy could be worst hit.

The blue-chip NSE Nifty 50 and BSE Sensex indexes sank 1.32% on Tuesday and have tumbled a shade over 2% in the past two sessions. The broader, more domestically focused mid-cap and small-cap indexes have slid a steeper 5%.

About 87%, or 2,532, of the 2,918 stocks listed on the National Stock Exchange declined on the day. In terms of market cap, the total value of all companies has fallen to $4.67 trillion from $4.85 trillion in the last two sessions.

The rout started after Trump said on Sunday that he would, later this week, announce reciprocal tariffs on all countries that impose duties on U.S. goods.

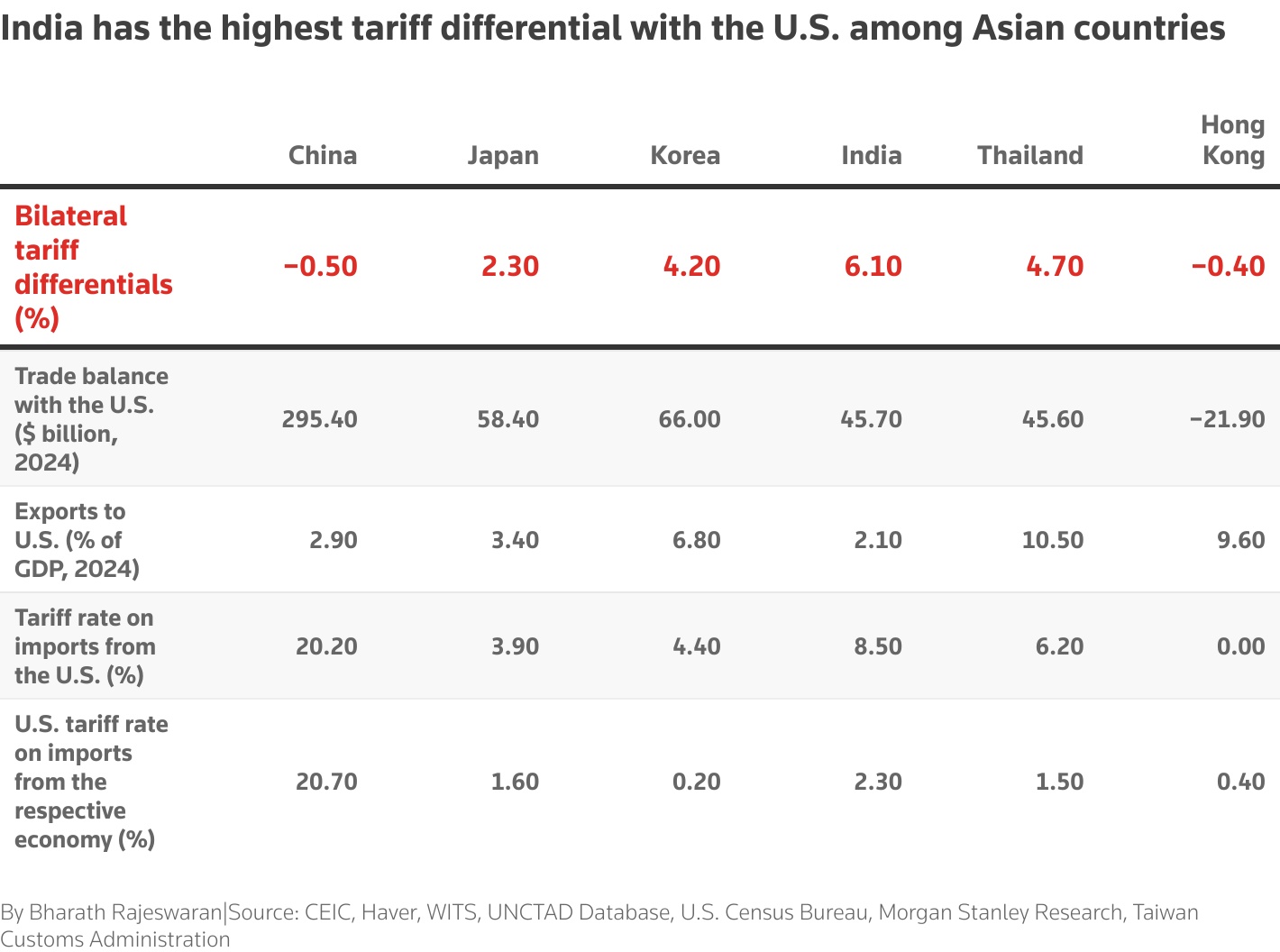

Trump’s top economic adviser has said India has “enormously high” tariffs. That, analysts say, makes India vulnerable to reciprocal U.S. tariffs, with Morgan Stanley and Citi estimating a hike of 4-6 percentage points.

“India likely to get hit the most among Asian countries. It is at high risk from potential U.S. reciprocal levies due to its pronounced tariff differentials,” said Satish Chandra Aluri, an analyst at Lemonn Markets Desk.

Since November 25, when Trump first threatened tariffs, the Nifty has fallen 4.7%. That is much steeper than the drop in two of Trump’s main targets via tariffs — China, which is up 1.7%, and Canada, which is up 1%. Only Mexico’s 5.4% drop is more than India’s.

“The markets now look forward to the upcoming meeting of (Indian Prime Minister Narendra) Modi with Trump later this week on hopes for any exemptions,” said Aluri.

To avoid a potential trade war, Modi is preparing tariff cuts and is also expected to propose increased energy and defence imports ahead of his two-day U.S. visit from Wednesday.

The tariffs, if imposed, are likely to hurt key exports such as electrical and industrial machinery, gems and jewellery, pharmaceuticals, iron and steel, textiles, vehicles, apparel and chemicals, said Sonal Verma, chief economist at Nomura.

Among stocks, every one of the 13 major sectors dropped at least 1%. Among them, the most U.S.-exposed pharma and IT tumbled 1.9% and 1.5%, respectively.