NEW DELHI, Dec 12 (Reuters) – Retail inflation eased in November as soaring vegetable prices moderated, boosting expectations of an interest rate cut by the central bank at its next policy review amid concerns around slowing growth.

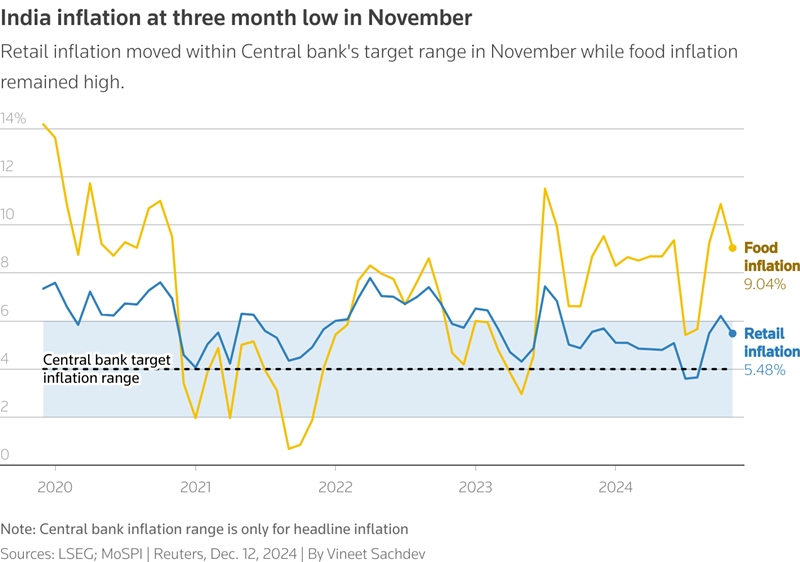

Retail inflation eased in November to 5.48%, lower than 6.21% in the previous month and below a 5.53% forecast by economists in a Reuters poll.

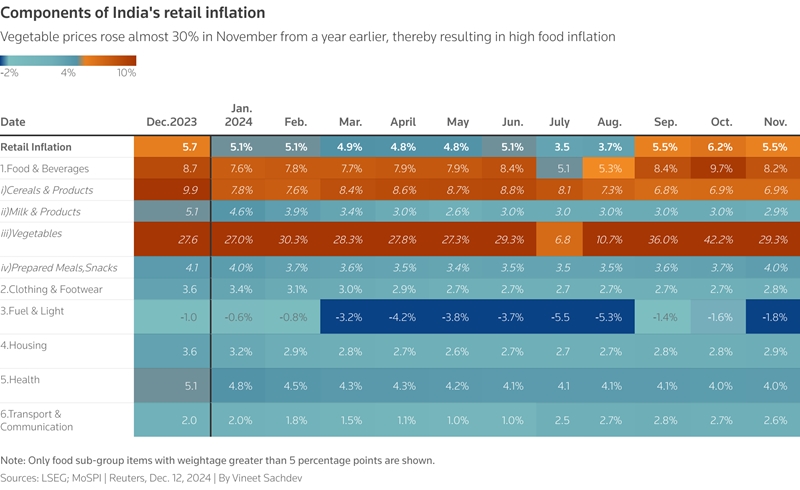

Food inflation slowed down to 9.04% from 10.87% a month earlier. Food accounts for nearly half of the consumption basket.

Vegetable prices rose 29.33% in November from a year earlier after rising 42.18% in October.

The decline in inflation, together with a sharp fall in growth in the July to September quarter to a seven-quarter low, supports expectations of a rate cut in February when the monetary policy committee meets next. The meeting would be the first after the appointment of new central bank governor Sanjay Malhotra.

“The deflationary trend in food prices, in particular vegetables, along with the lagged impact of softening demand amid food price deflation should aid headline CPI to fall below 5% in December,” said Garima Kapoor, an economist at Elara Securities.

She said she expects a 25-basis-point cut by the Monetary Policy Committee at the meeting in February.

The Reserve Bank of India (RBI) left interest rates unchanged earlier this month, but reduced the cash reserve ratio that banks are required to hold in order to ease monetary conditions and support growth.

Vegetable prices in November moderated due to a bumper summer crop harvest, aided by a favourable monsoon. A good monsoon, adequate reservoir levels and higher minimum support prices are also seen boosting winter crop sowing and production, in turn lowering food inflation in the coming months, according to the government.

The inflation rate for cereals in November was 6.88% in November compared to 6.94% a month earlier, while that for pulses was 5.41% against 7.43% in October.

“Further falls in food inflation will put downward pressure on the headline rate and softer economic growth should keep a lid on core inflation,” said economist Harry Chambers from Capital Economics.

Core inflation, which excludes volatile items such as food and energy and is seen as a better gauge of domestic demand, was between 3.64% and 3.7%, compared to 3.7% in October, according to two economists.

(Only the headline of this report may have been reworked by The Sen Times staff.)