NEW DELHI, Oct 14 (Reuters) – India’s retail inflation in September accelerated to its highest in nine months, due to higher food prices, according to government data released on Monday.

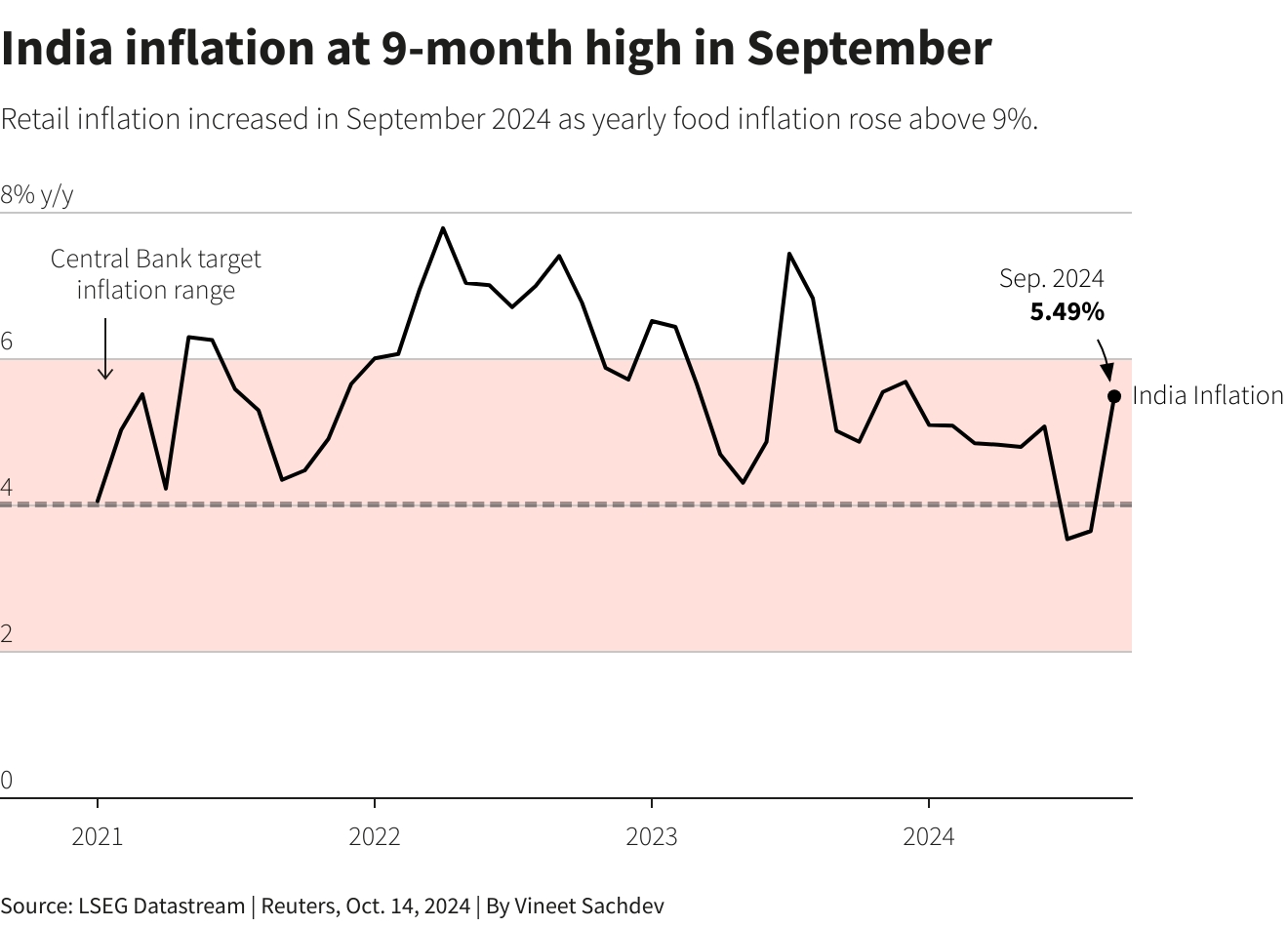

Annual retail inflation, opens new tab was at 5.49% in September, higher than 3.65% in August, and economists’ forecast of 5.04%.

The print was the highest since December 2023, when retail inflation was at 5.69%.

The Reserve Bank of India sees inflation easing after a few months of higher readings and expects it to average 4.5% in 2024-25, it said last week, when it changed its monetary policy stance to neutral and opened the door to rate cuts.

The central bank’s inflation target is at 4%.

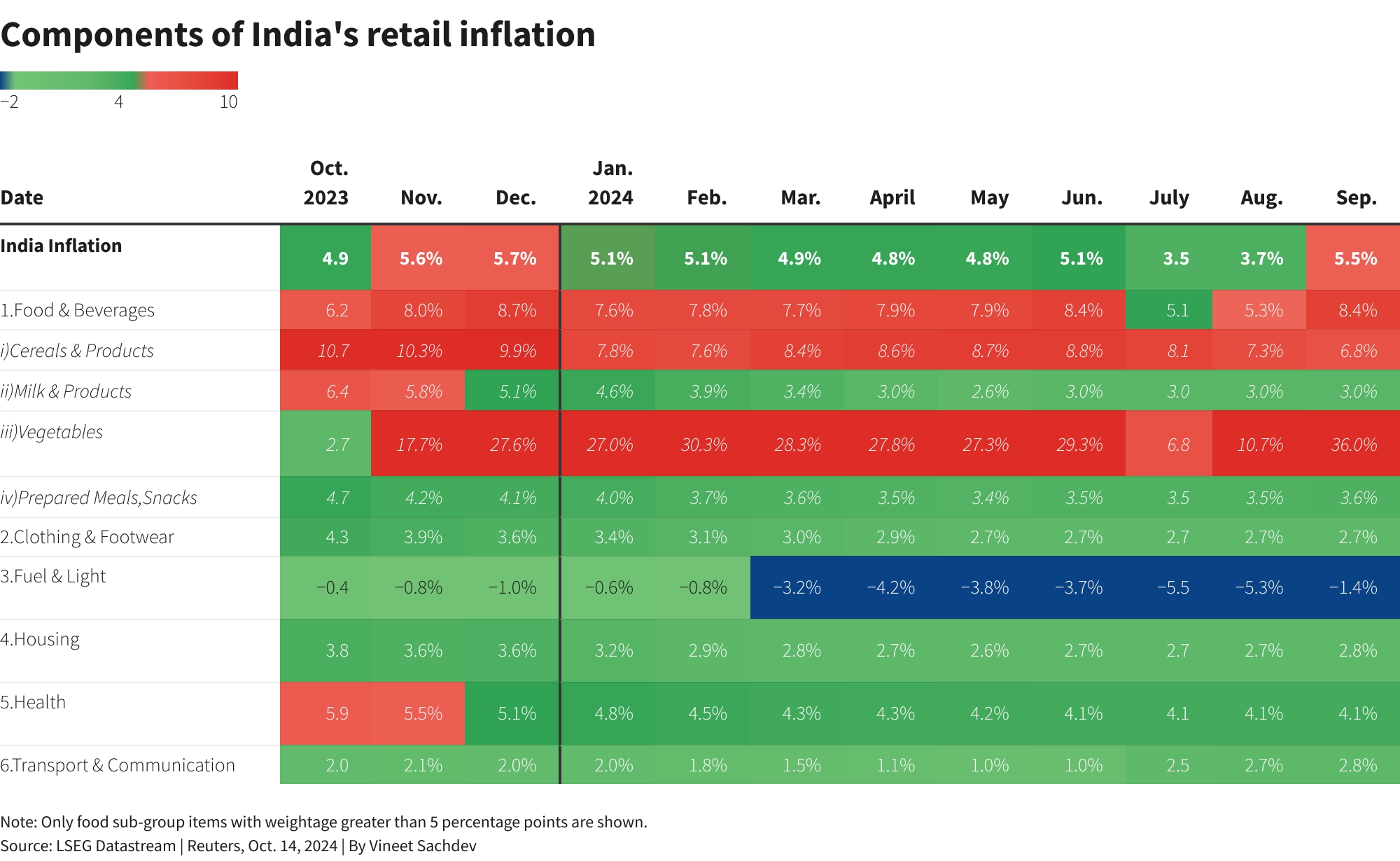

Inflation of food, which accounts for nearly half of the consumption basket, rose to 9.24%, compared to 5.66% in August.

Vegetable prices rose 36% year-on-year in September against a 10.71% increase in August.

The inflation rate for cereals was 6.84% in September compared to 7.31% in the previous month, while that for pulses was 9.89% against 13.6% in August.

September inflation rose sharply as the favourable base effect waned, while unfavourable weather conditions disrupted supply chains pushing up food prices, said Garima Kapoor, economist at Elara Securities.

RBI Governor Shaktikanta Das warned last week that significant risks to inflation persisted from adverse weather conditions, geopolitical conflict and the recent increase in some commodity prices.

Fears of a widening Middle East conflict and potential disruption to exports from the major oil-producing nations have pushed global oil prices higher to around $80 a barrel.

“Inflation uncertainties continue to persist in the near-term, particularly with the recent rise in commodity prices like vegetable oils,” Sakshi Gupta, economist at HDFC Bank, said.

Unseasonal rains could prove to be a risk as well.

India received above-average rainfall in September, and is forecast to witness unusually high rainfall in October, potentially damaging crops ready for harvesting such as rice, soybeans and pulses.

Core inflation, which strips out volatile food and energy prices, was 3.5% as against 3.3%-3.4% in August, according to two economists.

“The chances of a December rate cut at this stage remain low and are likely to hinge on how commodity price pressures evolve,” HDFC Bank’s Gupta said.

She forecast inflation falling back below 5% by the end of 2024.